The Head and Shoulders pattern is one of the most common reversal patterns. It is a complex pattern with several variants. This makes it difficult, especially for inexperienced traders, to accurately recognize and trade this pattern. This pattern is classified into two kinds. Bullish reversal and Bearish reversal. In this post, we will learn about the features of this pattern, basic trading techniques, and how to use the Streak platform to scan the stocks that form this pattern.

The Head & Shoulders Formation:

1) Bearish Reversal Head & Shoulders

Since this variant of the pattern is a bearish reversal pattern, It is also known as the H&S top. it is traded after the stock has gone through a significant up move. The pattern consists of three main components; The left shoulder, the head and the right shoulder.

The components:

- Head – This is the formation’s highest point. The head in H&S top should be higher than the two peaks on either side.

- Shoulders – The left and right shoulders are two tops that sit on either side of the main peak. They should ideally be symmetrical, i.e. at or around the same price level. Because these are exceedingly difficult to identify, asymmetrical shoulders are also commonly tolerated, as long as they are in vicinity.

- Neckline – A neckline is a trend line that links the bottoms of the two shoulders. Beak of this line usually signals a trade entry.

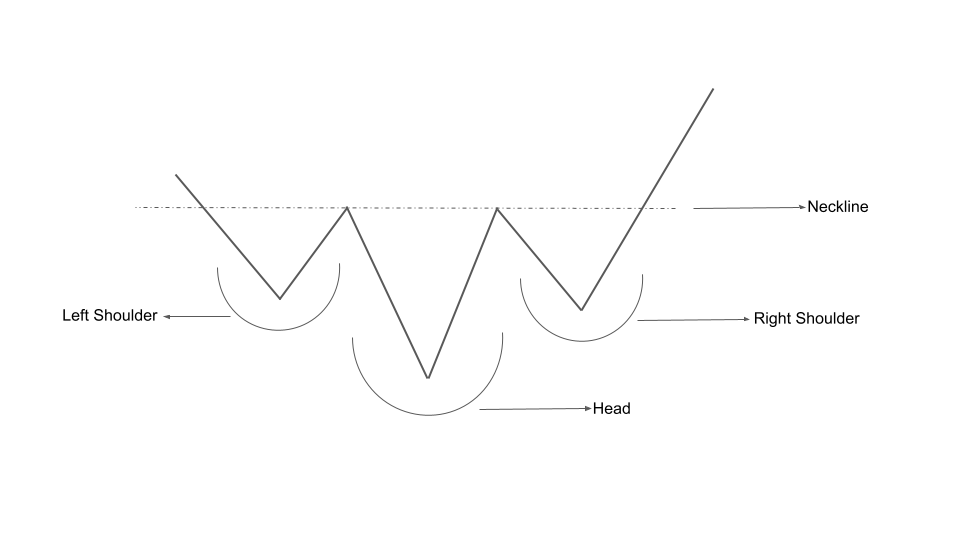

2) Bullish Reversal Head & Shoulders

This is the bullish reversal H&S pattern. Traders must look for this pattern after a significant downtrend in the stock. The pattern indicates that the stock might have bottomed and is ready to reverse its trend. The components are similar to the bearish reversal pattern discussed in the previous section.

Scanning for stocks with Head and Shoulders pattern

- Head & Shoulders Top (Bearish Reversal)

H&S formations are quite complex and are not very frequent. Not every head and shoulders pattern formation appears to be ideal. This scanning condition is more liberal for a head and shoulders pattern.

There is a trade-off between the frequency of occurrence and the degree to which a complicated pattern is defined. The next condition searches for considerably more distinct H&S patterns, although its incidence may be less common.

- Head & Shoulders bottom (Bullish Reversal):

This condition applies to the pattern’s more lenient variant. The conditions for the well-defined pattern may be constructed in the same way that the requirements for the bearish reversal pattern mentioned in the previous section.

Conclusion:

H&S is a complex pattern with several variations. In addition to the forms mentioned in this article, we have H&S patterns with two shoulders on each side. We’ll go through them in future articles. Because this pattern is difficult to detect, especially for beginning traders, the Streak scanner may be used to swiftly search through stocks for this formation.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.