Momentum trading is a very popular training technique among technical traders, yet a majority of them fail to have an intuitive understanding of price momentum. In this blog, we will understand what momentum exactly is, we will see one of the momentum indicators and then learn how to create strategies with it. Going forward we may use mom acronym for momentum.

What is Momentum?

In simple terms, momentum is the tendency of price to continue moving in a particular direction. Technically speaking, it is the rate of change of price. Strong mom can continue in an upward or downward trend. This can be confirmed by changes in trading volume and other technical indicators.

From the definition, it is quite evident that it is a good idea to trade high mom stocks if you are betting on a direction. Stocks with higher mom will have higher probability of continuing moving in the same direction.

Momentum Intuition:

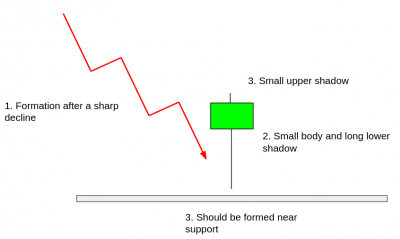

Whenever we are driving a vehicle, we slowly start accelerating it so that the vehicle picks up speed. Once we reach the desired speed, we stop accelerating and cruise at the required speed. To stop the vehicle, we slowly start applying the brakes, the vehicle still keeps moving for a while but the speed keeps decelerating until the vehicle finally stops.

Stocks behave in a similar manner most of the time. The mom starts picking up (analogous to car accelerating), the stock keeps moving in the same direction, the momentum slows down and finally the trend comes to a halt.

Practical Example:

This is the latest NIFTY daily chart as on 4th December 2021. In region 1 i.e stagnation, the index is simply moving sideways. After consolidating for a while, it broke out and the mom started picking up as shown by the region 2 i.e the acceleration phase. The increasing momentum can be visualized by the increasing slope of the arrows. The 2nd arrow in the acceleration phase is steeper than the 1st one.

After acceleration, the stock starts deceleration. In the deceleration phase, the stock is still moving higher but not to a degree that it did in the acceleration phase. Notice the slope of the arrow in region 3. Its slope has drastically decreased from the ones in the acceleration phase.

After decelerating, the Index briefly consolidated and then changed its trend.

The Price Rate of Change Indicator:

The price rate of change indicator is a momentum oscillator that measures the rate at which the price changes over a set period of time. The indicator oscillates above and below the zero line as the rate of change moves from positive to negative. When the bullish move accelerates, the indicator keeps rising above the zero line. And when the bearish move accelerates, the indicator keeps falling below the zero line, indicating positive and negative momentum respectively.

Creating Strategy:

The strategy takes a buy position when the PROC indicator is in the positive territory and then shoots up above its own moving average. This indicates a sudden increase in bullish momentum. The exit is based on fixed stoploss and target.

Conclusion:

Momentum is a very important concept in technical analysis. Various indicators are available to gauze it in the market. You can enter and exit quickly by reading the momentum correctly. Strategies and scanners can be developed on the Streak platform using various indicators to benefit from trading with mom concept.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.