Why should we learn about Delta

Options is a derivative product that means it derives its value from that of the underlying. To understand the impact of price movement of the underlying on the options premium, one needs to learn about delta. Delta can also help in estimating the probabilities of different strikes expiring in the money which can come handy while deciding which strikes to choose.

What is Delta?

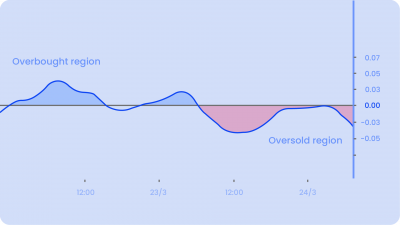

Delta determines the change in options price for a unit change in the price of the underlying. Simply put, if the price of the underlying changes by 1 rupee, the price of the option will change by ‘Delta’ amount. The value of Delta is always between 0 to 1 for Calls and -1 to 0 for Puts.

From the above images, we can infer that if we go deep OTM call delta approaches zero and if we go deep ITM, calls have delta approaches 1. For puts, we infer that if we go deep OTM put delta approaches zero and if we go deep ITM, put delta approaches -1.

A positive delta indicates a desire for bullish movement in the underlying. A negative delta indicates a desire for bearish movement in the underlying. A call option can never increase or lose value faster than the underlying contract, nor can it move in the opposite direction of the underlying market, assuming all other market conditions stay unchanged. Hence, the delta of call is bounded between 0 and 1.

Puts are similar to calls, with the exception that their values move in the opposite direction of the underlying market due to negative delta. Put delta ranges from -1 to 0.

Lets see an example

In this example, we can see how delta can be used to calculate new options premium after the stock has moved up by 10 points.

Estimating Probability with Delta

Ignoring the sign, Delta value of a strike is approximately equal to the probability that the option will expire in the money. As there is a 50-50 change of a stock going up or down at any given moment, the delta of ATM options is close to 0.5 (Ignoring the sign).

Eg. A call with delta 0.7 and a put with delta -0.7 both have a 70% probability of expiring ITM.

That’s the reason why ITM delta values are higher than OTM delta values, if we ignore the sign.

Strategy Example 1 on Streak

Strategy Example 2 on Streak

Bull call spread is a type of vertical spread. It includes two calls that have the same expiration date but different strike prices. Because the short call’s strike price is higher than the long call’s strike, this strategy will always result in a net debit. The premium from the short call is used to defray the expense of the long call.There is a limited profit and loss potential in the strategy. The strategy is delta positive hence it benefits if the underlying moves higher. All the calculations have been explained int he diagram above.

The Strategy:

Scanner Example 1 on Streak

Scanning for Nifty Strikes with -0.2 < Delta < 0.4

Scanner Example 2 on Streak

Scanning for all the put strikes available at the moment

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.