Put Option Analogy

Here we will try to understand put options with an example of insurance.

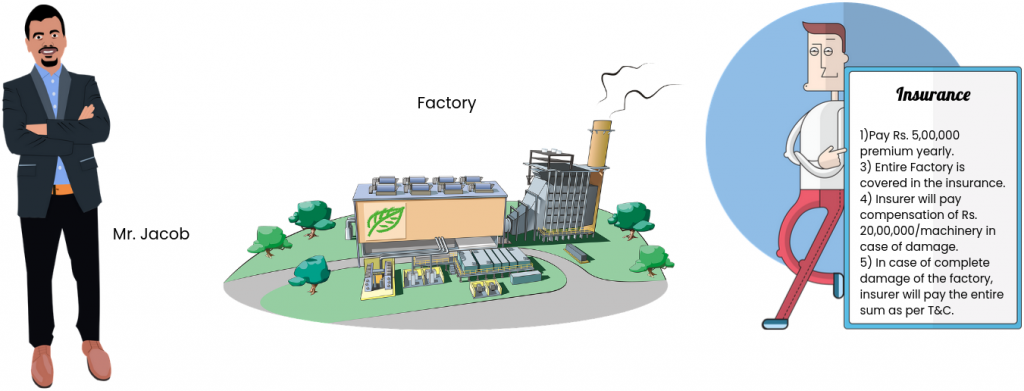

Mr. Jacob has set up a factory. To protect himself from financial shock due to any mishaps, Mr. Jacob purchases an insurance for the factory with the following conditions:

- He will have to pay Rs. 5,00,000/year to the insurer as premium.

- Rs. 20,00,000.00 will be paid per machinery if damaged due to accident.

- In case of complete damage to the factory, the insurer will pay entire sum of the factory as per the agreed valuation.

This insurance is very similar to a put option. Here the factory can be said to be the underlying, expiry is 1 year and the premium is Rs. 5 lacks. Insurance company can be compared to the put seller and Mr. Jacob as the put buyer.

If the factory looses value due to damage, the insurance company will have to pay Mr. Jacob. But if nothing happens to the factory during the period of the contract (1 Year in this case), the insurance company can keep the entire premium as their earning.

What is a Put Option

An agreement between a buyer and a seller to sell a specific stock at a specific price up until a specified expiration date is known as a put option.

A put option is a contract that gives the buyer the right, but not the obligation, to sell the underlying asset at a certain price (Strike Price) on or before a specific date (Expiry Date).

The seller of the option has to oblige and buy the share at the strike price if the buyer of the put option decides to exercise the option.

Buyers pay the premium and sellers receive the premium.

Intrinsic Value of a put option

The premium for an option is made up of both intrinsic and extrinsic value.

When compared to the current market price, intrinsic value shows how much the strike price actually is worth excluding the extrinsic value.

Time to expiration, implied volatility, dividends, and interest rate risks make up extrinsic value.

Put Option Intrinsic Value = Strike Price – Price of Underlying Asset

If the Intrinsic Value from the formula comes out to be negative, then it is simply considered as 0. This will happen if the underlying price is higher than the strike price for put options.

Put Option Payoff Diagrams

Greeks for Put Options

Strategy Example 1

Strategy Link: https://bit.ly/BPOS11

Put Credit Spread/Bull Put Spread

Strategy Example 2

Strategy Link: https://bit.ly/BPOS2

Scanner Example 1

This Scanner scans for Put Options with swelling premiums.

Scanner Link: https://bit.ly/PBScan1

Scanner Example 2

This Scanner scans for Put Options with high Open Interest

Scanner Link: https://bit.ly/BPScan2

Conclusion

An agreement between a buyer and a seller to sell a specific stock at a specific price up until a specified expiration date is known as a put option.

Buyers of the put have a bearish view of the underlying and the sellers have a bullish view.

Spread strategies can be created using puts that have limited risk and reward.

ITM stock options are physically settled if held till expiry.

All Index options are cash settled.

Options can be bought and sold before expiry to trade the premiums.

You can easily create and backtest options strategies on the Streak Platform.

Options Strategies can also be backtested on expired options contracts on Streak.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.