What is a Bullish Engulfing Pattern?

Bullish engulfing pattern is a simple candlestick pattern which gives early indication of trend reversal from bearish to bullish. A bullish engulfing forms when a small red candlestick is followed by a large green candlestick, with the large green candlestick completely engulfing the small red candlestick. This pattern is a strong indicator of a reversal in the current trend. This pattern should be used in conjunction with other technical indicators to confirm the reversal.

How can you identify a Bullish Engulfing Pattern

There are a few key things to look for when identifying a bullish engulfing pattern:

1. The pattern should form after a period of downward price action.

2. The first candlestick in the pattern should be a bearish candlestick.

3. The second candlestick in the pattern should be a large bullish candlestick that completely engulfs the first candlestick.

4. The bullish candlestick should open below the close of the bearish candle.

5. The bullish candlestick should close higher than the open of the bearish candle.

If you see a pattern that meets these criteria, then it is a bullish engulfing pattern and it is a sign that the market is reversing course and heading higher.

When is this pattern likely to occur?

When it comes to technical analysis with candlesticks, one of the most popular patterns to look for is the bullish engulfing pattern. This two-candlestick pattern occurs when a small bearish candlestick is followed by a much larger bullish candlestick, which completely engulfs the small bearish candlestick.

The bullish engulfing pattern is a strong indication that the bears are losing control and the bulls are taking over.

In line with the current trend, the bears were in charge of the market throughout the first bearish candle. The second candle begins lower than the first, but eventually bulls seize control and the price rises so much that it totally engulfs the bearish candle at the close.

This may cause fear among the bears, resulting in a short covering rally.

This pattern can occur at the end of a downtrend, or it can occur during an uptrend. It is important to note that the bullish engulfing pattern is much more powerful when it occurs at the end of a downtrend. This is because it signals a complete change in market sentiment.

How to trade a bullish engulfing candlestick pattern?

If you’re looking to trade this pattern, there are a few things you’ll want to keep in mind. First, this pattern is typically found at the bottom of a downtrend or near support levels. Second, you’ll want to wait for the candlestick pattern to form and confirm before entering a trade.

Here’s a step-by-step guide to trading a bullish engulfing pattern:

1. Identify a potential pattern.

2. Wait for the pattern to form and confirm. It’s important to wait for the second candlestick to close before entering a trade.

3. Once the pattern has formed and confirmed, you may enter a long position.

4. Your stop loss can be placed below the low of the pattern. Or it can be a fixed percentage or points based stoploss depending on your research.

5. The target can be the height of the pattern or it can also be a fixed percentage or points based target depending on your research.

Strategy Example

Strategy Link: https://public.streak.tech/in/0zzCYhL0cK

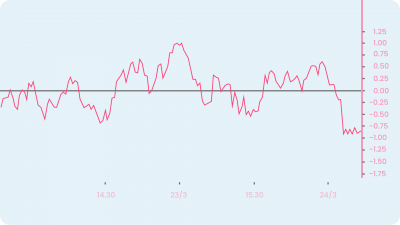

In this strategy example, buy entry is taken when a bullish engulfing is formed below the PP pivot level, which is when the stock has moved down, and then the next candle closes above the high of the bullish candle of the pattern. A close above the high of the bullish candlestick confirms the pattern. Exit is based on fixed percentage based stoploss and target. The backtest has been carried out in a period when the market was overall in a very bearish trend. The strategy may perform better when the market is in a overall bullish trend. You can try to run the backtest on different periods.

Conclusion

Bullish engulfing is a simple candlestick pattern which gives early indication of trend reversal from bearish to bullish. A bullish engulfing form occurs when a small red candle is followed by a large green candle, with the large green candlestick completely engulfing the small red one. The pattern can occur at the end of a downtrend or during an uptrend. It is important to wait for the candlestick pattern to form and confirm before entering a trade. You can create and backtest your ideas on the Streak platform to check the past performance and to optimize the strategy.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.