Using multiple time frames can help you gain a deeper understanding of the market dynamics and the overall trend. When the higher time frames show strong support or resistance levels, they can influence the price movements on the lower time frames. Moreover, when the trend is consistent across different time frames, you have a higher chance of entering a profitable trade. You can also use the lower time frames to fine-tune your entries and exits and optimize your risk-reward ratio.

What is Multi Timeframe Analysis?

Multi timeframe analysis is a technique that involves examining at least two or three different time frames of the same market. This allows traders to observe price action, indicators, trends, support and resistance levels on various time scales. By doing so, traders can avoid narrow vision and gain a wider perspective on the market conditions.

For example, suppose a trader wants to buy a certain stock. He can start by looking at the daily chart to determine the long-term trend of the stock. If the stock is in an uptrend, the trader will then look for buying opportunities or patterns on shorter-term charts to fine-tune his entry point.

Multi Timeframe Analysis Example

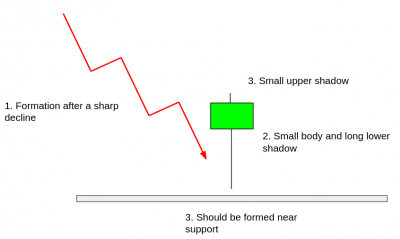

Lets try to understand how multi timeframe analysis can help with an example. Lets say we are observing two stocks, Stock A and Stock B. The daily timeframe for both the stocks is showing signs of reversal and the pattern on daily timeframe looks very similar for both the stocks.

On the hourly timeframe, both the stocks are forming a channel. However, Stock A has retraced from the top channel line and Stock B has bounced form the bottom of the channel line. If you are looking a swing trade opportunity solely based on technicals, which one would you prefer? I am sure most of you would want to go with Stock B.

As you can see, we were unable to decide which one is a better buying opportunity just by looking at the daily timeframe. Looking at an additional timeframe helped us make that decision.

The Multi Timeframe Function on Streak

The multi timeframe function allows users to perform multi timeframe analysis i.e check conditions on two different timeframes in a single strategy.

This is how it can be done:

Select the lowest time frame on the top as the main timeframe of your strategy. Eg. If you want to check RSI on 5 min, hourly and daily timeframes in your strategy, you will select 5 min (the lowest timeframe) as the main timeframe on the top and use multi timeframe functions to access RSI on hourly and daily timeframes as shown in the above image.

MTF V/s MTF Completed

On the streak platform, you will find two multi timeframe functions. One is called “multi timeframe” and the other is called “multitimeframe completed”. In this section, we will understand the difference between both the functions.

| Parameter | “Multi Timeframe” | Multi Timeframe Completed |

| Condition Verification | Checks condition on the ongoing incomplete candle. | Checks condition on the last completely formed candle. |

| Signal Visibility on Chart | As the candles can change even after the signal is generated, the signals may not be visible on the charts as the charts show only completely closed candles and not partial candles. | Live signals are always visible on the charts as the candle cannot change after the signal is generated. |

Best Practices while using Multi Timeframe

1) If you are using Multi timeframe function, along with the symbol function, multi timeframe should be used inside the symbol function.

2) Crosses above/Crosses below comparators should not be used between two MTF or MTFc functions.

3) Multi timeframe (Not Multi timeframe completed) may have look ahead bias while backtesting. This can result in very good backtest results which does not translate to good performance in live market scenario. This has been explained with an example below:

4) Conditions on higher timeframes must account for the data that is available during backtest for the selected base time frame.

There is a “backtesting window” for each timeframe. “Backtest window” is basically the time duration on which backtest can be run at once or the amount of historical data on which the backtest can be run at once. The backtest window for different timeframes has been shown below:

If I am using 1 min as my main timeframe in the strategy, I can backtest on 30 days of data in one go. This window can be shifted backwards to do backtesting on more historical data. In the 1 min base timeframe strategy, if I create a SMA 200 condition on daily timeframe, we will not have enough data to correctly calculate SMA 200 as 1 min main timeframe fetches data of only a little over 30 days. This incorrect condition is illustrated in the image below:

Strategy Example 1

Strategy Link: bit.ly/mtfst1

Video Explanation:

Strategy Example 2

Strategy Link: bit.ly/mtfst2

Video Explanation:

Scanner Example 1

Scanner Link: bit.ly/mtfc1

Video Explanation:

Scanner Example 2

Scanner Link: bit.ly/mtfscanner2

Video Explanation:

Conclusion

Using multiple time frames in your analysis can help you gain a deeper understanding of the market dynamics and the overall trend. When the same trend is confirmed on different time frames, you have a higher chance of entering a profitable trade. You can use a higher time frame to identify the market direction and a lower time frame to find an optimal entry point for your trade. Streak offers two MTF indicators that allow you to use multiple time frames in a single strategy. The ‘Multi Timeframe’ function evaluates the current ongoing candle, while the ‘Multi Timeframe Completed’ function evaluates the previous candle that has been fully formed.

FAQs

Multi timeframe analysis is a technique that involves examining at least two or three different time frames of the same market. This allows traders to observe price action, indicators, trends, support and resistance levels on various time scales. By doing so, traders can avoid narrow vision and gain a wider perspective on the market conditions.

Using multiple time frames can help traders gain a deeper understanding of the market dynamics and the overall trend. When the higher time frames show strong support or resistance levels, they can influence the price movements on the lower time frames. Moreover, when the trend is consistent across different time frames, traders have a higher chance of entering a profitable trade. They can also use the lower time frames to fine-tune their entries and exits and optimize their risk-reward ratio.

Traders can start by looking at the higher time frame to determine the long-term trend of the market. They can then use the lower time frames to find buying or selling opportunities that align with the long-term trend. By doing so, they can avoid trading against the overall market trend and improve their chances of success.

The Multi Timeframe function on Streak is a function that allows users to perform multi timeframe analysis i.e check conditions on two different timeframes in a single strategy. Traders can select the lowest time frame on the top as the main timeframe of their strategy and use multi timeframe functions to access conditions on higher time frames.

Some best practices to follow while using Multi Timeframe Analysis include using the Multi timeframe function inside the symbol function, avoiding Crosses above/Crosses below comparators between two MTF or MTFc functions, accounting for the data that is available during backtest for the selected base time frame, and using Multi timeframe completed to avoid look-ahead bias.