Generating consistent profits in the stock market can be challenging, and negative returns are not uncommon, even with a well-thought-out trading strategy. However, understanding the reasons behind negative returns can help you refine your strategy and improve your performance. In this blog post, we will discuss four common reasons why your trading strategy may generate negative returns. By analyzing these factors and making appropriate adjustments, you can increase your chances of achieving positive returns.

Small profit margin: To be profitable, most transactions must generate a profit that’s large enough to cover the losses and transaction costs. If your trading strategy only yields a small profit per trade, you may end up losing money on each trade, and even a slight increase in profit may not be enough to account for loss-making trades. For example, arbitrage strategies may seem profitable, but their transaction costs may make them unfeasible.

Small profit and loss margin per trade = Small profit margin

High transaction costs: Every time you buy or sell a stock or a FnO instrument, you incur transaction costs, including brokerage, STT, transaction charges, GST, SEBI charges, and stamp duty. If your strategy involves many transactions, these costs can quickly add up and erode your profits. Streak‘s backtest report considers all transaction costs apart from DP charges and shows all these calculations. Check the number of transactions your strategy generates, and consider reducing it if it’s too high.

More transactions = More transaction charges, which in turn is eating into profits or adding to losses

Frequent square-offs: Brokers levy call and trade charges when intraday positions (MIS and CO) are not closed before the square-off time and the broker has to close the position. If your trades are getting auto-squared off frequently, you may incur additional costs in the form of call and trade charges. For example, the square-off charges are currently Rs 50 + GST, and they can quickly eat into your profits. Check the frequency of square-offs, and consider adjusting your strategy to reduce them.

Small quantity: If you’re testing your strategy with a small quantity or lot size, you may not generate enough profit to cover the transaction costs. The impact of the cost on the profit generated using one quantity will be high and there is a high chance, it may not generate post-brokerage profit. Consider increasing the quantity to a more reasonable level, such as 100, where the profit generated can service the brokerage and square-off charges.

If you’re experiencing negative returns with your trading strategy, don’t give up. Instead, analyze your strategy and consider the factors above. Making small adjustments can help you improve your strategy and achieve better results. Remember, making money in the stock market is not easy, but with the right approach and mindset, it’s possible to succeed.

Here are some solutions to the above problems

A. Reduce the number of trades – The main advantage of reducing the number of trades will bring down the transaction cost. To reduce the number of trades, you can

1. Review your Target and Stop Loss: You need to set a suitable Stop Loss that is not met very easily and yet not very big so that the strategy remains profitable. Ideally, the Reward (Profit) of the strategy should be bigger than the risk (Loss). For Example, you can try keeping an SL slighter bigger than the Average True Range (ATR) or the instrument.

2. Set a specific number of Strategy Cycles: A Strategy cycle consists of an Entry followed by the respective Exit of a strategy. Once a strategy is deployed, the stocks are periodically tracked based on the conditions in the strategy. Currently, Streak allows setting up to 100 Strategy cycles.

3. Change the Strategy timeframe: You need to focus on catching the long-term trend based on hourly or daily trends instead of scalping. If you are using a short timeframe, the stock may go up or down after your enter multiple times. It is generally difficult to gauge the trend due to the volatility of a smaller timeframe. However, If you are using hourly time frames or daily timeframes you can easily identify a trend using a trend-following indicator like Supertrend.

B. Increase the Quantity: Simply increasing the quantity may significantly affect the profitability of your strategy. For example, If your strategy was making INR 32.50 cumulative profit for 1 quantity of the stock and incurring INR 349(assumed) as cumulative cost including Square off charges for 1 quantity; just changing the quantity to 100, will multiply your profit 100 times i.e 32.50×100 =3250, while the cost can go up (due to Transaction/Turnover Charges) to 446(assumed) but you are making a net profit now. 3250 -446 = 2804

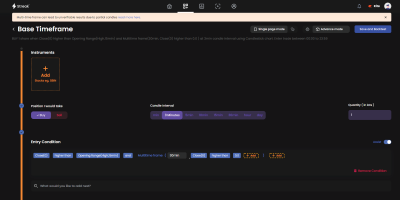

C. Eliminate the Square off Charges: You can eliminate the call and trade charges by setting an Exit condition to exit any position before the Square off time. You can use the Candle time feature of Streak to create conditions to exit at a specific required time. For Example, the following exit condition in the image will exit a trade at 15:15 in a 3-minute timeframe strategy.

Important: In backtest the MIS strategies exit/square off at 03:15 PM (15:15), and no further trades are considered after 15:15 in the backtest. However in the live market Streak does not auto-square off any MIS positions or other positions, the auto-square off is done from your broker’s end. During the Live trading, the MIS strategies get expired at 03:20 PM (15:20) by default as this is considered mostly the auto square-off time for the brokers.

You can also learn about more examples of adding other types of exit conditions here.

Additionally, you can focus on creating strategies for liquid stocks since it will reduce the impact cost (slippage).

Backtesting can help you simulate your strategy under various market conditions and identify potential issues. However, it’s essential to use backtesting correctly to get reliable results. Ensure that you use appropriate indicators, timeframes, and conditions, and aim to trade frequency, and increase the net gains per quantity traded.

With Streak, you can change the indicator, and timeframes, add multiple conditions, etc. The idea behind backtesting is to get you to profitable trades (historically) so that you know the risks involved. The metrics like win-loss ratio, max drawdown, etc are listed in the backtest result of Streak for each instrument and will help you make better decisions.

Happy Trading! 🙂