Elder Ray Index is a momentum indicator that provides insights into both bullish and bearish forces at play in the market. In this article, we will understand the Elder Ray Index indicator, exploring its components, calculation, and how to use this indicator.

What is the Elder Ray Index:

Developed by Dr. Alexander Elder, the Elder Ray Index is a trend-following oscillator that assesses the strength of bullish and bearish pressures in the market. An oscillator is a type of technical indicator whose value fluctuates between a defined upper and lower range.

The Elder Ray Index is composed of two distinct components: the Bull Power and the Bear Power component.

Bull Power

The Bull Power component measures the extent to which buyers have the upper hand. It is calculated by subtracting the Exponential Moving Average (EMA) of the selected period from the High price of the candle. A positive Bull Power value indicates that the High price is above the EMA, which is considered a bullish sign.

Bear Power

The Bear Power component measures the strength of the bears in the market. It is derived by subtracting the EMA of the selected period from the Low price of the candle. A positive Bear Power value indicates that the Low price is below the EMA, implying bearish sentiment.

Formula:

Here is the formula for calculating the Bull Power and Bear Power components:

Bull Power = High – EMA(N)

Bear Power = Low – EMA(N)

“High” refers to the High price of the current candle

“Low” refers to the Low price of the current candle

EMA(N)” refers to the Exponential Moving Average of the selected period (Default: 13)

Only one parameter is required i.e. the EMA period. The default parameter value is 13.

Interpretation:

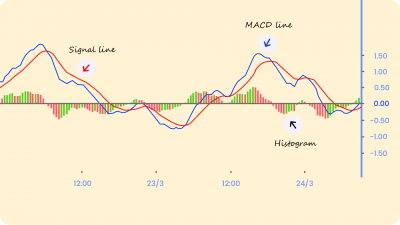

Interpreting Elder Ray Index involves analyzing the relationship between the Bull Power and Bear Power components. When the Bull Power (Green Histogram) is positive, it means the High is above the EMA. Similarly, when the Bull Power is negative, it means the High is below the EMA. Thus if Bull Power’s value is positive and increasing, it means that the buyers are becoming more powerful and able to push the price up.

When the Bear Power (Red Histogram) is positive, it means the candle Low is above the EMA and when the Bear Power is negative, it means the candle Low is below the EMA. When Bear Power’s value is negative and decreasing, it means that the sellers are gaining momentum.

How to use the Elder Ray Index:

Here are some specific examples of how the Elder Ray Index can be used:

Trend Confirmation: When Bull Power and Bear Power values match with the prevailing trend, it can act as confirmation of the trend. Rising Bull Power during an uptrend and increasing Bear Power during a downtrend confirm the trend’s direction.

Direction Strength Assessment: By comparing the value of the Bull Power, Bear Power, you can understand the trend strength.

Example: If both the Bull and Bear Power is positive it means the High and the Low of the candle is above the EMA. However, if Bull Power is positive and the Bear Power is negative it means the candle High is above the EMA while the Low is below the EMA.

Trend Reversal Identification: A divergence occurs when the Bull Power and Bear Power indicators move in opposite directions from the price action. This can be a sign of a potential trend reversal.

Example: If the price is rising but the Bull Power value is falling, it could be a sign that the uptrend is losing momentum and a reversal might be possible.

Sample Strategy:

Let us now create a trend-following Long strategy in Streak using the concepts discussed above.

Entry: I will enter a long position when the Bull Power and Bear Power are positive and the current value of Bull Power is higher than the current Bear Power. Hence, the first three conditions. Here is a snapshot of the conditions:

Also, we want to enter a trade early when a new trend emerges so I have added the 4th condition to check whether the Bull Power was negative in the last 5 candles.

Exit: I will Exit my position when the Bull Power becomes negative or at a Stop Loss of 3% and 25%.

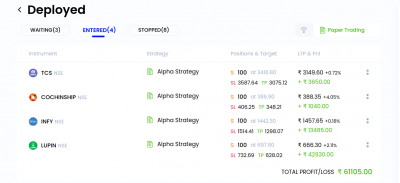

The stock selection is random, some stocks from different sectors have been taken. Here is the backtest result:

You can access the backtest result, copy the strategy and modify the logic on any stock of your choice.

Conclusion:

While the Elder Ray Index is a useful tool, like any other indicator, it has its limitations. The Elder Ray Index is a trend-following indicator and can produce false signals in choppy or sideways markets due to its sensitivity to price fluctuations. This indicator is more effective when used in combination with other indicators. Since moving averages are used in the calculation of Bull Power and Bear Power, this can add a lag in the indicator’s responsiveness to recent price changes. You need to backtest your strategies thoroughly before using them in the live market.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.