Learning anything new requires some time to understand the basics and then diving straight into implementing these basics practically. As you move forward, you gain confidence and then start exploring other advanced features, understanding your own unique style and then finally everything becomes intuitive.

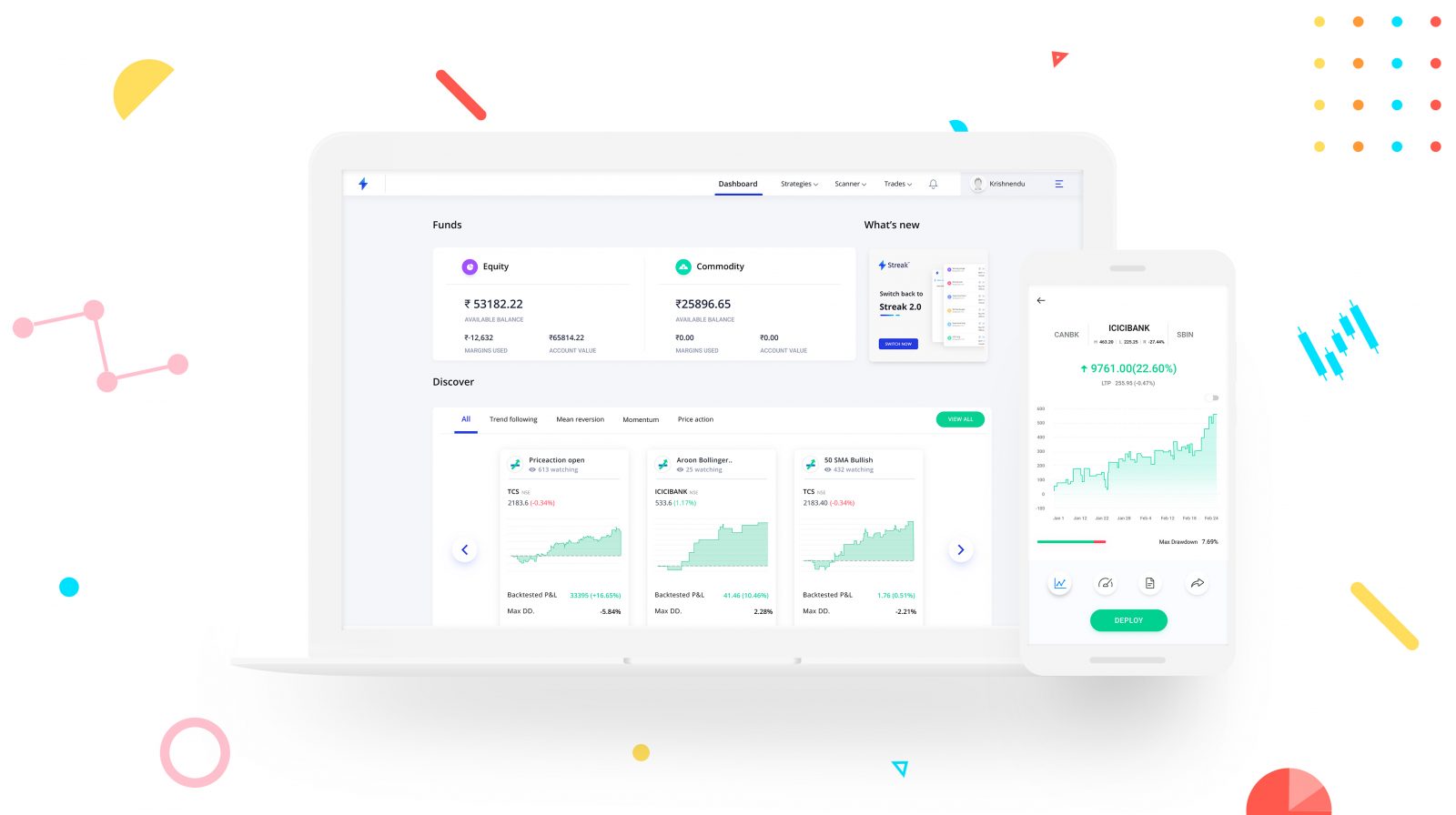

Streak is perhaps one of the most simple and elegant products in its class and is very user-friendly, especially for new users, because of its awesome user interface. But some new users find learning how to use the platform difficult, mainly because, they are not aware of the free resources available. This article is dedicated to absolute beginners in the market and new to Streak.

Steps for getting started

1. Watch this introduction webinar, on how to think and approach trading as a system and create a basic trading strategy

2. Read the Help section

3. Start creating basic strategies in Streak, whenever you get stuck, your first source of reference for understanding Streak is the Help section

4. If you need help with understanding the basics of the market and finance, you can refer to the awesome content in Zerodha Varsity. Apart from this, you want to further focus on Techincal Analysis, you can learn from this website.

5. Once you have successfully understood the basics, start exploring the different tools available- Scanners, Technicals

At this point, you should be having a very broad understanding of the platform. Then start working on your own trading strategy. Remember step one of creating any technical strategy starts by observing charts. Notice how different indicators behave when the stock is trending and consolidating, Then formulate a strategy hypothesis and start backtesting it Streak as discussed in Step 1.

After you have successfully backtested a strategy and are satisfied with the result. Deploy your strategy for Paper trading. This is key and it allows you to basically forward-test your trading strategy without risking your capital. Read more on this here.

There are some other sources of information that you can refer to discuss and learn how other traders are using Streak and their trading style

- TradingQna – a discussion forum for all thing related to trading and stock market

- Join the Streak Telegram community – a place for chatting with fellow traders and Streak team, discussing ideas, issues, experience

- Apart from this, you can write to [email protected] with everything related to Streak – any payment/account-related issues, plan up-gradation, feature request, the support team will help you with this. You can also ask for help with your strategy implementation if you are unable to create your idea in Streak.

Points to Remember

- What is the basic structure of any query/condition in a strategy or scanner?

Any condition that you create in Streak follows a basic structure of having

Indicator comparator IndicatorNow you can learn more about it here and here. But some new users try to create a condition in the following manner.

Indicator comparator Indicator comparator Indicator This is not the correct way of writing your condition and it will not work, may give an arbitrary result. So now, how would you write your condition, if you want to implement an idea like the one above? Here is how:

Indicator comparator Indicator AND Indicator comparator Indicator You can use the AND/OR to combine your conditions. Of course, you can read about this here, but I wanted to take this opportunity and point out what should not be done.

2. How to read and interpret a backtest result?

A critical part of creating and optimizing a strategy is understanding how a strategy is behaving, when it is taking an Entry, and also focus on when and how it is taking an Exit.

In order to understand this, you should be able to interpret any backtest result. And I have discussed this elaborately in this Medium article. You must read and understand how the backtest works if you want to advance in systematic trading approach. The backtest reflects how a live trade would work in Streak and understanding backtesting would make you aware of what to expect when you deploy a Live trade.

Now I would be concluding the article.

If you read through and follow these steps, your skill in using the platform and knowledge of systematic trading would grow quickly and soon it would all become intuitive. Having reasonable expectations from the market and working on your technical skill will help you in the long run. Let me know if you find this helpful and write in the comment if you want ant to me to include anything else here.

1)What if we start a trade using streak on a desktop while at office n then switch to mobile app while out of office? Will it create logging in from mobile app?

2) what about the orders placed on Kite platform which are not through strategy deploymt directly? Do we have to close them directly from the same platform manually?

Hi Suhas

1. You can simultaneously use both Desktop and the app. There will not be any issues.

2. If you have placed orders from Kite separately, you can close them using the Kite app. If you have deployed a strategy and placed the order as a part of it, it can be stopped nad exited from Streak and Kite both.

Hi Krishnendu,

Can you please help me understand if there is any error in the below strategy, when I am trying to run back it says no trades happened

BUY 1 share when Symbol(INDICES_NIFTY BANK, EMA(close, 60, 0) crosses above EMA(close, 20, 0) ) and EMA(close, 200, 0) higher than EMA(close, 60, 0) at 5 minutes candle interval using candlestick chart. Enter trade between 09:30 to 23:59Read less

Hi Anand,

The logic seems to be fine. But you need to check the chart for this to be true. If there are crossovers and your condition is met and the system will show trades. In case you find the condition to be true and still no trades is triggered during the backtest, please write to [email protected]