Introduction:

Rarely we come across a tool that can fix multiple issues. Ichimoku is such a tool in a trader’s arsenal that can be used in a variety of ways to help make trading decisions.

Ichimoku, also known as Ichimoku Kinko Hyo was developed in the 1930s by Goichi Hosoda, a Japanese journalist so that he could gauze price movements at a glance using one single indicator. It can be used to define support and resistance levels, trend and momentum. The indicator consists of 5 lines each serving a different purpose.

Initially, it might look quite overwhelming but it is a very straightforward and easy indicator once one understands it.

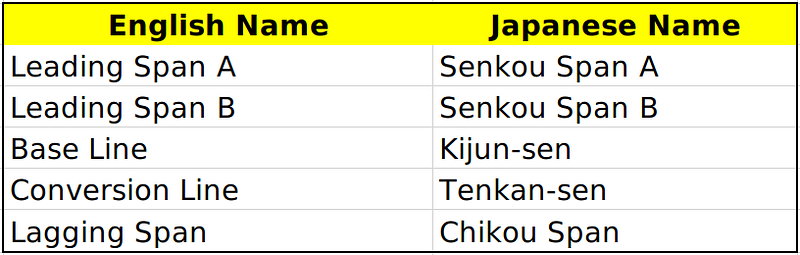

The naming convention for Ichimoku:

All the lines that form the indicator originally had Japanese names. And when the indicator became popular in the west, the English naming convention was also widely adopted. The image below shows the indicator with the English names and the table below it shows the Japanese equivalent of the English names.

- Conversion line: (9 period high + 9 period low)/2 — This line is the midpoint of 9 period high and 9 priod low

- Base line: (26 period high + 26 period low)/2 — This line is the midpoint of 26 period high and 26 period low

- Leading Span A: (Conversion Line + Baseline)/2 — This line is the midpoint of Conversion line and baseline

- Leading Span B: (52 period high + 52 period low)/2 — This line is the midpoint of 52 period high and 52 period low

- Lagging Span: Close price(latest candle) ploptted 26 period in the past

Out of all the five lines, the conversion line is the fastest line and follows the price most closely followed by the baseline. Leading Span A and Leading Span B lines are shifted 26 periods in the future after calculation. Due to this, the cloud is visible 26 periods into the future where the price is yet not plotted as seen in the image above.

Analysis using Ichimoku Indicator:

The cloud is formed by Leading Span A and Leading Span B lines. The cloud is green when Leading Span A is above Leading Span B and it is red when Leading Span A is below Leading Span B. Leading span A moves faster than Leading Span B.

Bullish Trend: The price is trading above the cloud

Bearish Trend: The price is trading below the cloud

Consolidation: The price is trading in between the cloud

Strong Uptrend: The price is trading above the cloud and Leading Span A is above Leading span B (Green cloud condition) and the Leading Span A line is rising.

Strong Downtrend: The price is trading below the cloud and Leading Span A is below Leading span B (Red cloud condition) and the Leading Span A line is falling.

Since Leading Span A and Leading Span B are the slowest lines of all, they are used to analyze the bigger trend. The cloud acts as support and resistance levels and since it is plotted 26 period in the future, it also shows future support and resistance levels. As the conversion line and base line move faster, they are used to generate trade signals or analyzing the momentum.

Conversion line crossing above the base line is considered as a bullish signal and conversion line crossing below the base line is considered a bearish sign. The cloud can be used to gauze bigger trend and within the bigger trend, conversion line and base line can be used for entries and exits.

Conclusion:

Though Ichimoku is a very old indicator, it is still widely used in the markets. It is one of the most versatile indicators as it can be used to gauze many different parameters of the market. The indicator can be very overwhelming to look at initially but once the use of each line is understood clearly, it becomes very easy to interpret the indicator. It can be used on its own or combined with other indicators and chart types to create successful trading strategies. Strategies can be developed on the Streak platform without coding.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell or otherwise deal in investments.