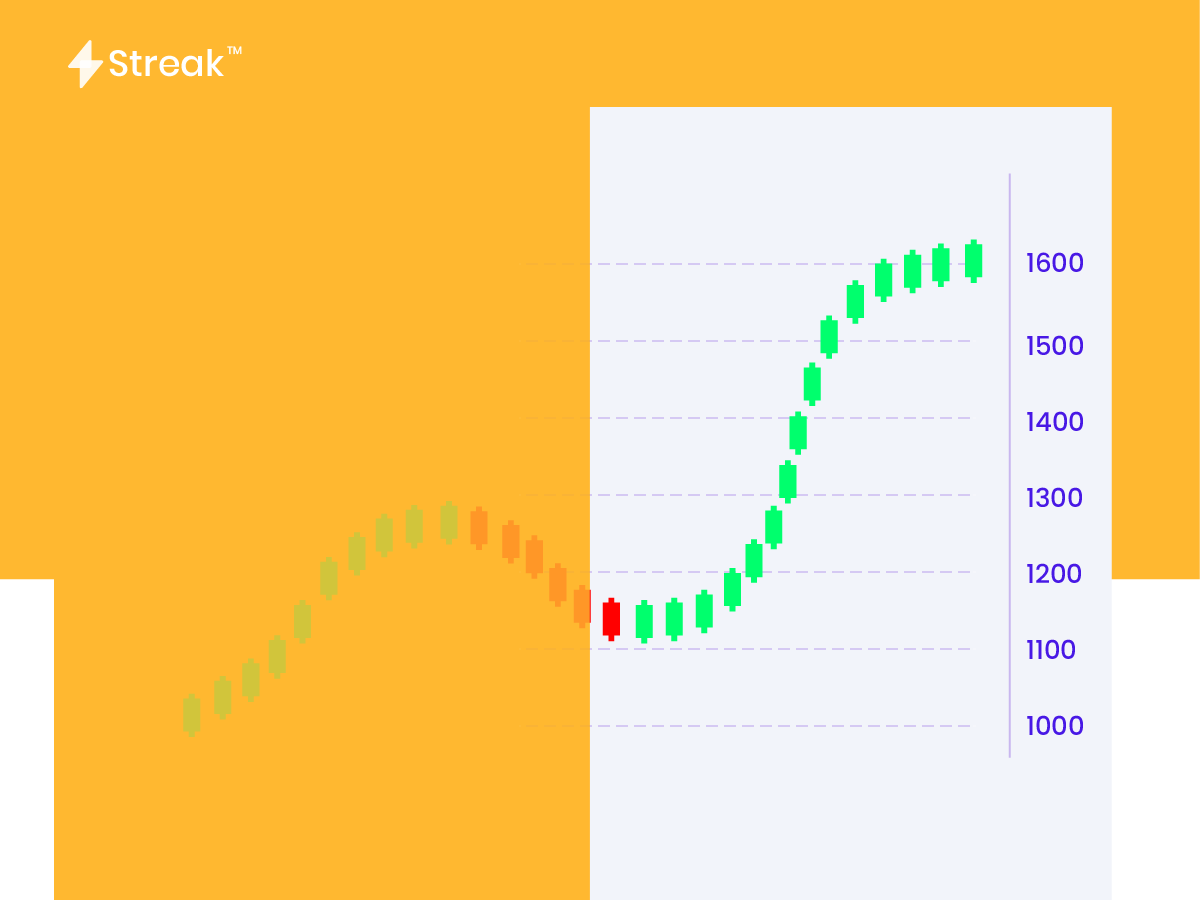

With Dynamic Contracts, you can analyze and trade across multiple scrips! To understand this better, we need to talk about the top-down analysis of individual stocks. So, whenever you perform Technical Analysis (TA), you usually test out different indicators on the stock you need to buy or sell. To guide investment choices, a top-down approach focuses more on macroeconomic factors such as the GDP, broad sectors like NIFTY, industrial sectors like BANKNIFTY, CNXIT, CNXFINANCE, etc., or options contracts.

You might be thinking, how does this help? Basically, you are doing your analysis provided by the same stock you’re going to trade. Using a top-down approach to include indicator readings from other instruments can provide additional confirmation and noise reduction.

Let’s look at this with the help of a scanner on Streak:

Important Terms:

- Open Interest

Open Interest or OI is the number of open (outstanding) futures or options contracts for a particular market. The open interest provides a more accurate picture of the options trading activity, and whether money flows into the futures and options market are increasing or decreasing. A set number of shares are listed on the exchange when the company goes IPO. Trading happens in those shares. However, a fixed number of futures and options contracts are not listed. Contracts are created when a seller and a buyer agree to create contracts by entering into a trade.

| Volume | Open Interest |

| Increases every time a contract is created or closed. | It increases when new contracts are created. |

| Total Volume cannot decrease. | Total Open Interest decreases when contracts are closed |

| It is a total of all the transactions taking place. | It is a total of all the outstanding or open contracts. |

| It Indicates cash flow in and out of the market. |

- Put Call Ratio

The Put-Call ratio can help traders to determine the sentiment of the options market. The ratio compares if more puts or calls are being bought. Some traders use Total Volume and some traders use total Open Interest to calculate Put call ratio. Since Open Interest is a better measure of the money flowing in and out of the F&O market, we will be using the total open interest. We just need to add the total OI of puts and divide it by the total OI of calls. It is not necessary to include far out of the money and far in the money strikes as their probability is extremely low. Put call ratio higher than 1 indicates that more puts are being bought and less than 1 indicates more calls are being bought. Hence a high PCR indicates bearishness and a low one indicates bullishness. The indicator is often used as a contrary indicator as well, similar to overbought and oversold levels. The best level to trade can be found with backtesting as it differs from stock to stock.

Formula: PCR(OI) = Puts OI/Calls OI

Conclusion

A top-down approach can be incorporated into strategies using indicators from the index.

It can help in trading along with the trend of the overall market.

The dynamic contract feature will help automatically select the appropriate strike price.

Open Interest differs from Volume.

Open interest is a better measure of activity in the derivatives market.

The Put-Call ratio can be used as a sentiment indicator.

Backtesting should be carried out to find the appropriate Put-Call Ratio for each sector and stock.