Are you looking for the best support and resistance indicators? It’s quite a common question among traders as Technical trading relies heavily on the notion of support and resistance levels. Numerous market participants continuously track and analyze key support and resistance levels to identify trading setups, as well as stop-loss and profit levels.

You can refer my previous blog to learn the basics of support and resistance here : http://35.200.218.105/support-and-resistance-basics/

Pivot Points

Pivot Points are leading indicators. It estimates future support and resistance levels by comparing the high, low, and close prices of the previous period. There are many variations of pivot points available. We will be focusing on the standard pivot points in this article.

To intuitively understand pivot points, we shall look at the definition of the word ‘Pivot’

Dictionary.com defines ‘Pivot’ as

‘a pin, point, or short shaft on the end of which something rests and turns, or upon and about which something rotates or oscillates.’

Now, we can relate the same generic definition to stock prices. Pivot Points are important price levels near which the stock can rest, turn (change trend) or oscillate between two pivot levels.Previous day’s Open, High, Low, Close prices are used to calculate current day’s pivot points.

Moving Averages

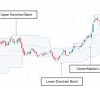

Technical analysts employ moving averages because they are one of the most basic and long-standing indicators they have available to them. There are several moving averages, each with unique advantages and downsides, but they are all employed in the same way.

They are a very versatile indicator. Moving averages provide dynamic support & resistance levels. Dynamic because moving averages change with each candle. Many traders look at 50 and 200 period moving averages as major support and resistance levels. Though they are dynamic, their interpretation and usage is similar to any other type of support and resistance levels. While using moving averages as support/resistance, traders must look for evidence like pattern formations or price reaction near these averages to validate its effectiveness as support/resistance.

The above image shows the NIFTY 50 chart with 20 SMA. As we can see, several times, the price has taken support on the SMA.

VWAP

Another great indicator to find intraday support and resistance is the VWAP indicator. Volume Weighted Average Price (VWAP) is a technical analysis technique that calculates the average price based on volume. This implies that the indicator prioritizes price levels with higher volume. Institutional traders use VWAP price to place orders.The value of VWAP is reset at the beginning of each trading session. We can see how the price reacts near VWAP in the below image:

Identifying Stocks Forming Patterns Near Support/Resistance

Streak scanner has made it fairly simple to scan for pattern formations near S & R levels. In this section, we are going to see two examples of how this can be done.

Example 1: Green Hammer Formation on VWAP

These simple conditions can help us identify stocks where a hammer pattern is formed on the VWAP indicator. It will work with any sector, timeframe and chart type. As per these conditions, the tail of the candle must be at least twice the length of the body. You can change this feature by changing the number ‘2’ in the second condition. An example of result:

The Red Line is VWAP line.

Example 2: Green Hammer Formation within 0.5% Range of SMA

These conditions will help us identify stocks that have formed a green hammer pattern above SMA 50 but within a range of 0.005% of the SMA. You can adjust the % range by changing the 1.005 parameter in the last condition. Rest of the conditions are the same as the previous example.

An example of result is shown below:

The Red Line is SMA 50 line.

Conclusion:

There are several indicators available to help you identify support/resistance levels. In this post, we explored three such indications. Pivot Points, for example, is a leading indicator, but Moving Averages and VWAP are lagging indicators that provide dynamic support and resistance levels.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.