What are Options?

Options contract is a derivative instrument. It derives its value from some other underlying asset. The asset could be an index, a stock, commodity, currency etc.

A call or put option is a contract that gives the buyer the right, but not the obligation, to buy (if you buy call) or sell (if you buy put) the underlying asset at a certain price (Strike Price) on or before a specific date (Expiry Date).

Calls V/s Puts

Call Option Analogy

Let’s say that Mr. Meet as his eyes on a shop near his house. There is a news that a new road is going to be constructed in front of the shop which will increase traffic near the shop and hence its value will appreciate due to higher footfall. The shop is on sale for Rs. 5000000 but Mr. Meet does not have so much amount right now and he is not even sure that the road will get constructed. So he goes to the property dealer to ask if he can make an arrangement for him.

The dealer makes Mr. Meet an offer. He prepares a contract. A snippet of the contract is below:

The non refundable deposit is comparable to the option price (premium). Rs. 50,00,000.00 is comparable to the strike price. 6 Months is comparable to the expiry date.

As per the contract, Mr. Meet can pay a non refundable deposit to lock the deal. Since he is paying for the deal, he also has the right to call off the deal if he wants. In that case, the dealer will get to keep the contract fees (Non refundable deposit). The dealer cannot call off the deal as he has taken the money for the contract. Kindly watch the video for detailed explanation:

Moneyness of options:

Moneyness is a term used to describe the relationship between a derivative’s strike price and the price of its underlying asset. Moneyness tells us whether exercising the option contract at present will lead to a profit.

If exercising the option right now results in profit (excluding premium), then those options are called In-the-Money. Eg. All Call option strikes below the Current Market Price.

If exercising the option right now results in a loss (excluding premium), then those options are called In-the-Money. Eg. All Call option strikes below the Current Market Price.

The table below explains which strikes of calls and puts are ITM, OTM and ATM:

The number-line below assumes Nifty is trading at 16000. Based on that, all the strikes on the left side i.e strikes lower than CMP are ITM Calls and OTM Puts. While all the strikes on the right side i.e strikes higher than CMP are ITM Puts and OTM Calls.

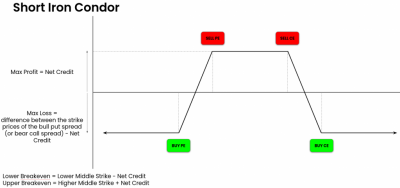

Call & Put Payoff Diagrams

The payoff diagrams above show us the profit/loss scenarios for long/short puts and calls on expiry. X is the strike price and Y is the breakeven point.

Strategy Example 1

Strategy Link: https://bit.ly/Put-Options

The strategy buys Bank Nifty put options based on the indicator signals on Bank Nifty Index. Please refer the video for detailed steps to create the strategy:

Option Pricing and Greeks

Options Pricing

Price of an options contract depends on various factors such as strike price, underlying price, time to maturity, implied volatility and interest rates. There are various pricing models that traders use to calculate theoretical fair value of options.

Greeks

Greeks are variables (values) that determine how the options price will change if any of these factors change.

Scanner Example 1

The following scanner scans for all the strikes that have delta higher than 0 i.e all the call option strikes.

Link to the scanner: https://bit.ly/DeltaScan

Scanner Video:

Strategy Example 2

Strategy Link: https://bit.ly/Call-Options

The strategy buys Reliance call options based on the indicator signals on Reliance stock. Please refer the video for detailed steps to create the strategy:

Scanner Example 2:

The following scanner scans for strikes where IV has been increasing for the last 3 candles.

Link to the scanner: https://bit.ly/IV-Scan

Scanner Video:

Conclusion

Options contract is a derivative instrument. It derives its value from some other underlying asset.

Moneyness is a term used to describe the relationship between a derivative’s strike price and the price of its underlying asset.

Pay-off diagrams help us visualize profit/loss at various expiry levels.

Greeks are variables (values) that determine how the options price will change if any of these factors change.Options strategies can be created on the Streak platform and can even be backtested on expired contracts.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.