Volume plays an important role in technical analysis since it helps in understanding the demand and supply of an asset. In this article, we…

Technical Indicators

Know about more than 70 indicators

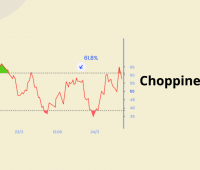

Understanding the Choppiness Index Indicator

Traders often wonder how to avoid sideways markets. In this article, we will discuss a Technical indicator that can help you do just that…

Understanding the Elder Ray Index Indicator

Elder Ray Index is a momentum indicator that provides insights into both bullish and bearish forces at play in the market. In this article,…

Understanding Range and True Range

Range and True Range are the building blocks of understanding price volatility in financial markets. Range gives a basic overview of price movement, while…

Demystifying Average True Range (ATR)

In this current volatile market environment, understanding price movements and volatility is essential for all market participants. One of the key technical indicators that…

Time Series Forecast (TSF): All you need to Know

The Time Series Forecast (TSF) is a technical indicator that uses linear regression to plot a line that best fits historical price data. The…

Inside Bars: All you need to Know

In this blog, we’ll delve into the concept of Inside Bars, explore their characteristics, and discuss strategies to leverage their power in your trades.…

Buying Low and Selling High: The Art of Trading Overbought and Oversold

Overbought and Oversold technique is very useful for trading in sideways markets and getting favorable entries in trending markets. When the market is overbought,…

Buying V/s Selling Options

Buying V/s Selling Options is a very common topic of discussion among traders. There are pros and cons to both buying and selling options.…

Bearish Engulfing Pattern: Here’s what you need to know.

In technical analysis, a bearish engulfing pattern is a chart pattern that consists of a small green candlestick followed by a large red candlestick…