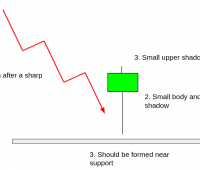

Introduction to hammer candlestick pattern A hammer candlestick is a type of candlestick pattern that is used to signal a bullish reversal in the…

Topics

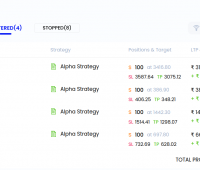

Important articles about strategic trading with Streak

The easiest way to do paper trading

We have all written mock tests and played practice matches to identify our weaknesses, to test our strengths and to prepare ourselves for the…

Overcoming Trading Biases with Streak

The human brain can process a huge amount of information and do multiple tasks at the same time. For example, on a busy road,…

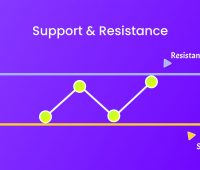

Support and Resistance with Streak

Section 1: What Are These Levels Everyone Talks About? The Support and Resistance are specific areas on the Technical Chart that represent a huge…

Basics of Put Options Trading with Streak

Put Option Analogy Here we will try to understand put options with an example of insurance. Mr. Jacob has set up a factory. To…

Trading with Greeks on Streak – Part 2 (Theta Decay and Time Value)

Options are a depreciating asset, meaning that their value decreases with time.In option pricing, time is extremely crucial. Changes in time have a significant…

Candlestick Charts

First of all, let’s thank the Japanese rice markets for giving us one of the most useful and handy ways to read a price…

Assumptions of Time in Your Trading-Candle Intervals

Did you know, our system of minutes, hours, and days has been with us since ancient times when people developed it based on a…

Market Volatility

In simple terms, volatility is the frequency or degree with which the price of a stock (or the stock market as a whole) fluctuates…

Trend Trading

If you’re a trend trader, you’re asking the market to ‘show its hand.’ In other words, you use the data available to you and…