What is Intraday Trading & why should we learn it? No Overnight Risk as all the positions are closed on the same day before…

Options Trading

Moneyness of Options 101: A Beginners Guide

Moneyness is a term used to describe the relationship between the price of an underlying asset and the strike price of an option. There…

Buying V/s Selling Options

Buying V/s Selling Options is a very common topic of discussion among traders. There are pros and cons to both buying and selling options.…

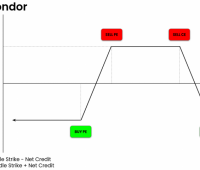

Is Iron Condor better than short straddle options strategy?

In this article, we are going to learn about Iron Condor (Short Iron Condor). We will learn about its theory, benefits and we will…

Basics of Put Options Trading with Streak

Put Option Analogy Here we will try to understand put options with an example of insurance. Mr. Jacob has set up a factory. To…

Trading with Greeks on Streak – Part 3 (Delta)

Why should we learn about Delta Options is a derivative product that means it derives its value from that of the underlying. To understand…

Trading with Greeks on Streak – Part 2 (Theta Decay and Time Value)

Options are a depreciating asset, meaning that their value decreases with time.In option pricing, time is extremely crucial. Changes in time have a significant…

Backtesting Short Strangle on Nifty Expired Contracts

Backtesting is a very important part of the trading strategy creation cycle and one must spend an adequate amount of time testing their strategy…

Using the Option Greeks Indicator – Impact On Option Premium and More

Introduction The price of the option does not always appear to move in tandem with the price of the underlying asset. A variety of…

Open Interest – All you need to know

Introduction: When we start learning about the markets and trading, Price and Volume are the two data that we are first introduced to. It…