How to Read Candlesticks? Candlestick charts are a type of graphical depiction of a financial instrument’s price fluctuations, such as a stock, currency pair,…

Uncategorized

Moneyness of Options 101: A Beginners Guide

Moneyness is a term used to describe the relationship between the price of an underlying asset and the strike price of an option. There…

Buying V/s Selling Options

Buying V/s Selling Options is a very common topic of discussion among traders. There are pros and cons to both buying and selling options.…

Trading with Bands and Channels

You can quickly and easily visualize price activity and volatility using bands and channels. They also make it simple to spot price extremes. bands…

Double Bottom Pattern: Here’s What You Need to Know

A double bottom is a bullish reversal pattern that forms after a significant downtrend. The pattern is created when the price action tests a…

Changelogs Ninja

Id Title Description Read More Visible Expire Time Broker 1667536199 🚨Positions entered during 9 am to 9.40 am might not be tracked, so make…

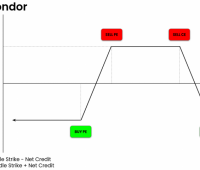

Is Iron Condor better than short straddle options strategy?

In this article, we are going to learn about Iron Condor (Short Iron Condor). We will learn about its theory, benefits and we will…

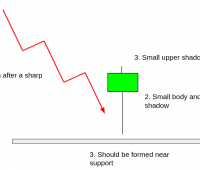

This Simple Trick Could Help You Recognize the Hammer Candlestick Pattern

Introduction to hammer candlestick pattern A hammer candlestick is a type of candlestick pattern that is used to signal a bullish reversal in the…

Buy a call or sell a put? Must know for option traders.

Introduction There are two ways you can trade naked options having a bullish view. Buying a call or selling a put, both these positions…

Basics of Put Options Trading with Streak

Put Option Analogy Here we will try to understand put options with an example of insurance. Mr. Jacob has set up a factory. To…