Call Options Analogy Let us try to understand call option with this analogy. Mr. Ravin bought a coupon for XYZ Garments shop by paying…

Uncategorized

Basics of Options Trading with Streak

What are Options? Options contract is a derivative instrument. It derives its value from some other underlying asset. The asset could be an index,…

Understanding candlestick formation and backtest results in Streak

The proof of pudding is in eating and this should rightly be the approach for anyone involved in the capital market. Being skeptical about…

Introducing Dynamic Futures and Trading with Trailing Stoploss

Why Learn Futures Trading? Short positions in equities cannot be carried overnight. However, futures allow us to do that. Trading in indices is also…

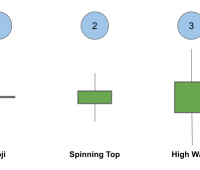

Trading the High Wave Candle

Every candlestick gives us an insight about the market. Most of the new traders are aware about doji and spinning top candlestick patterns. However…

Trading with Greeks on Streak – Part 3 (Delta)

Why should we learn about Delta Options is a derivative product that means it derives its value from that of the underlying. To understand…

Trading with Greeks on Streak – Part 2 (Theta Decay and Time Value)

Options are a depreciating asset, meaning that their value decreases with time.In option pricing, time is extremely crucial. Changes in time have a significant…

FAQs

Is Streak Free to use? Yes, Streak Scanner(scanners.streak.tech) is free to use, but the “streak.tech” platform remains unchanged and will continue to be a…

What is Moneyness of an Option Contract?

Moneyness is a concept that is most usually associated with put and call options, and it indicates whether the option would profit if exercised…

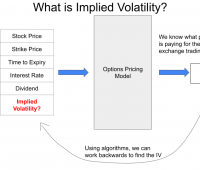

Trading with Greeks on Streak – Part 1 (Vega and IV)

Implied volatility helps us understand the extent of positive or negative movement that the market participants are expecting in coming days. It tells us…