The double top pattern is a bearish reversal pattern that is created after an extended uptrend. When the price makes two successive highs that are almost equal, a double top pattern is formed. When the price breaks below the support formed by the lows created between the two highs, the double top pattern is considered complete.

How to identify a Double Top Pattern

The pattern gets its name from the two peaks that form at the resistance level. The pattern is considered a bearish reversal pattern because it typically forms after the stock has been in an uptrend. When the pattern forms, it signals that the stock is losing momentum and that the uptrend may be coming to an end.

The double top pattern is created by the stock’s price action. To identify the pattern, you will need to look for two distinct peaks that form at the same resistance level. These peaks should be followed by a breakdown of support before the stock begins its downtrend.

How to trade the double top pattern?

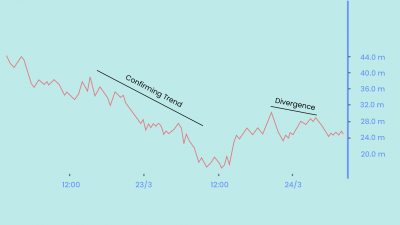

Traders with a very high risk appetite may start entering in small quantities if they spot bearish reversal candlesticks at the resistance level when the second peak (Top 2) is forming with a strict stop loss above the resistance formed above the 1st top. If the price breaks above the 1st top, it can move upwards very quickly. Traders may enter the trade completely only once the support level is breached by the price. Often, the stock will give a pull back to the breakout level after the breakout. Entering after the pullback gives better risk/reward.

If the pattern fails to breakout, there is a probability that the pattern turns out to be a rectangle pattern.

How to calculate the stoploss and target?

Double top is a classical chart pattern. For classical chart patterns, the target price is calculated by finding the height of the pattern and then projecting it from the breakout level. In this case, the height of the pattern will be projected downward from the support level. Traders can either exit the entire quantity or partially exit and trail the remaining quantity.

The stop loss can be placed right above the tops. For a better risk/reward, traders can also place the stoploss at half the target amount to maintain a risk/reward of 1:2.

Scanning for potential double tops with Streak

Scanner Link: https://public.streak.tech/in/XgU7yk855W

This simple scanner can help you scan for stocks forming a double top pattern. The scanner is suitable for daily timeframe. The same scanner will work on smaller time frames as well with small modifications. You will need to reduce the 1.02 and increase the 0.98 values for lower time frames. Eg. 1.01 and 0.99 can work for hourly time frame. For doubts and any queries, you can contact us at [email protected]. We will be glad to assist you within a few hours.

Conclusion

The double top pattern is created when the price makes two successive highs that are almost equal. The pattern gets its name from the two peaks that form at the resistance level. When the price breaks below the support formed by the lows created between the two highs, it is considered complete.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.