Supertrend is one of the popular technical indicators every new trader looks into, perhaps because of its simplicity. It is a trend following indicator that works best in trending markets but gives false signals during choppy or congestion phase.

The Supertrend indicator does not predict the direction of the trend but indicates the direction once the trend is established. It is plotted over the price chart and it changes its color to Green or Red based on the price movement.

Supertrend requires only two parameters to be set, period and multiplier. The period refers to the period to be considered while calculating the Average True Range (ATR). The default values used while constructing a Supertrend indicator are (10, 3) i.e. 10 for the period and 3 for the multiplier.

Understanding ATR is important before using Supertrend. ATR is used to measure current average volatility, which is then multiplied using the multiplier value. The indicator is basically trying to indicate a direction when the price moves and makes a large enough move so as to touch and cross above 3 times the current average volatility.

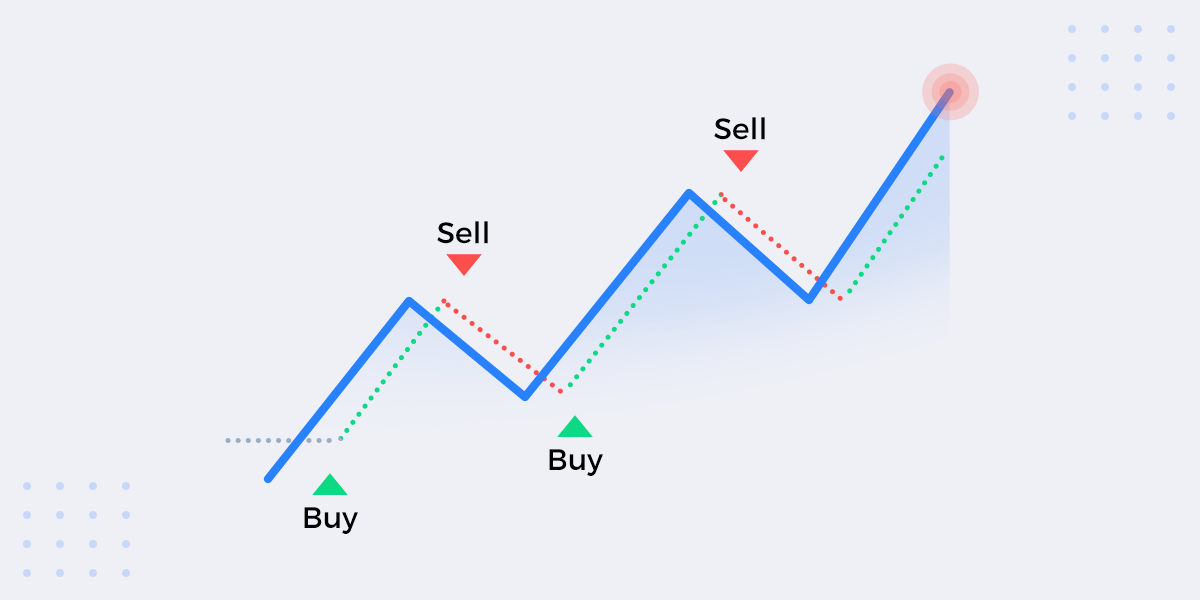

BUY/SELL signal

Supertrend gives a clear buy/sell signal when plotted over a price chart. A buy signal is generated when the close price crosses above the Supertrend line. Similarly, a sell signal is generated when the close price crosses beneath the Supertrend line.

Implementing Supertrend in Streak

Now with this, let us go ahead and create a strategy based on Supertrend. Consider the following chart:

It is clear from the chart that there was a trend reversal on 28th Jan and the price started trending upwards. After plotting Supertrend on the chart

We can see that Supertrend gave a buy signal on 28th Jan and gave a sell signal when the price retraced. Based on this information we can form a strategy: when the Supertrend line is below the close, it is time to buy. When the Supertrend line is above the case, it is time to sell.

Now that we have formed a strategy, let us backtest this on historical data. We are going to use Streak for this. Streak is a platform that enables traders to easily create, backtest and deploy their trading strategies without the need to spend hours on coding, collecting and cleaning data. With Streak, it takes only a few minutes to ideate and test your strategies.

We are going to put in the same logic in Streak and see how the strategy would have performed if we were to trade PFC based on signals generated by Supertrend (10,3).

Let us now backtest this idea.

As we can observe from the Backtest result, the strategy would have made me a profit of 14.59% post expense when I would have made only 8.95% if I would have bought and held the stock till 29th Jan. So, the strategy made 5.64% extra (alpha). Further, we can also observe that we made profit 29 times and lost 23 times and whenever the strategy made a profit, it made an average of INR 1.46, whenever the strategy lost, it made a loss of INR 0.91, 91 paise. Hence from a risk management perspective, this is perfect.

You can create such profitable strategies or check the viability of your idea easily. Just head over to www.streak.tech and sign up today.