In this blog, we’ll delve into the concept of Inside Bars, explore their characteristics, and discuss strategies to leverage their power in your trades. While “Inside bar” may sound simple, inside bars hold significant potential for traders who understand how to interpret and utilize them effectively.

What is an Inside Bar?

An inside bar is a candlestick pattern that occurs when the High and Low of a candlestick are contained within the high and low of the previous candle. Visually, it appears as a smaller candle engulfed by the preceding candle. This pattern represents a temporary equilibrium in the market, indicating indecision or consolidation among traders.

Generally, all candlestick patterns that have a small body represent indecision in the markets, and candlestick patterns that has a large body represent strength.

How can you identify an Inside Bar?

The Inside Bar consists of a smaller candlestick, known as the “Inside” or a “Child” candle, which is completely engulfed by the range of the preceding candlestick, known as the “Mother” candle. The High and Low of the inside candle should be within the High and Low of the mother candle.

Analyzing volume during the formation of an Inside Bar can provide additional insights. A decrease in volume during the Inside Bar period suggests a decrease in market participation and further confirms the indecision.

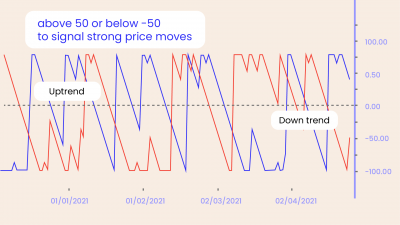

An Inside Bar is more meaningful when it occurs after a significant price move, either an uptrend or a downtrend. The pattern implies a pause in the prevailing trend, indicating a potential reversal or continuation.

Scanning an Inside Bar

Let us now understand how to create an inside bar scanner in Streak. To create any patterns we need to focus on the O H L C structure of the pattern and the body-to-wick ratio of the candles. If you observe the above image we can see that for inside bars, a smaller range (high-low) candle needs to form after a larger range candle. Also, the high and low of the smaller range candle needs to be within the range of the previous larger range candle. We will add the same logic in Streak

- High(0) – Low(0) lower than High(1) – Low(1) i.e. the range of the current candle is smaller than the range of the previous candle.

- High(0) lower than High(1) and Low(0) higher than Low(1) i.e. the current high is lower than the previous high and the current low is higher than the previous low.

That’s it! Its so simple…

In case you were not able to follow, here is the scanner link: https://public.streak.tech/in/hSXHfpmOn4

The color of the bars in an Inside Bar pattern doesn’t hold much significance, so there’s no need for additional conditions based on color. However, if you wish to you can also make more customizations. For example, here is a scanner link (https://public.streak.tech/in/DniJuv9p0W) where we have further mentioned that the mother candle has a red body and the child candle has a green body and that the body of the child candle needs to be within the body of the mother candle.

How to trade the Inside Bar pattern?

Trading an Inside Bar pattern typically involves two main strategies: the breakout strategy and the reversal strategy.

Bullish Breakout Strategy:

- Wait for the pattern to form and check the preceding trend

- Confirm by observing the next candle

- If the next candle breaks above the High of the Inside candle, it indicates a bullish breakout. You can consider entering a long position.

- You can set the Stoploss below the Low of the mother candle or the breakout candle

- The target can be percentage based or you can use an indicator-based exit condition discussed in this blog.

Creating Bullish Breakout Strategy in Streak

Let us understand how to create the above strategy in Streak.

Entry:

We will use the logic discussed above to identify the Inside Bar pattern and to check the preceding trend we will use a trend-following indicator – SuperTrend. Then we will add another condition to check whether the close of the next candle closes higher than the high of the inside candle.

- High(1) – Low(1) lower than High(2) – Low(2) i.e. the range of the inside candle is smaller than the range of the mother candle.

- High(1) lower than High(2) and Low(1) higher than Low(2) i.e. the inside candle High is lower than the mother candle High. similarly, the inside candle Low is higher than the previous Low.

- Low(3) higher than Supertrend(7,3,3) i.e check if the Low of the third last candle was higher than the SuperTrend three periods before to check if the preceding trend is bullish

- Close(0) higher than High(-1) and Close(0) higher than Open(0) i.e. the Close of the current candle closes higher than the High of the inside candle. Additionally, I have added that the breakout candle is a Green candle

Exit:

Setting a Stoploss and Target is mandatory in Streak and hence I have set the SL: TP as 3:6. To set the Stoploss below the Low of the mother candle or the breakout candle, you can add an Exit condition.

Close(0) lower than Signal candle(Low,2) i.e the current Close price is lower than the third last candle from the Signal candle

Here is the backtest result when tested for all Nifty 50 stocks on 1-day timeframe. The backtest was for the period of May 20. You can also access the strategy via the link shared below.

Here is the Strategy link: https://public.streak.tech/in/Ingi25zV6p

Conclusion

Inside Bars can help traders in identifying potential trend continuations and breakouts. By utilizing appropriate tools like the Streak scanner, you can capitalize on the potential opportunities presented by this pattern. Volume analysis during the formation of an Inside Bar can provide additional insights. You can use the Scanner shared above and paper trade the strategy shared in this blog. Let me know your thoughts in the comments below or write to us at [email protected].

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.