Moneyness is a term used to describe the relationship between the price of an underlying asset and the strike price of an option. There are three categories of moneyness: in the money, at the money, and out of the money. This classification assists traders in determining which strike to trade in a given market situation.

What is In-the-Money?

An option is “in the money” if the current price of the underlying asset is higher than the strike price of a call option or lower than the strike price of a put option.

Call option example: if the current price of a stock is Rs. 1000 and the strike price of a call option is Rs. 900, the option is said to be “in the money”

Put option example: if the current price of a stock is Rs. 1000 and the strike price of a put option is Rs. 1100, the option is said to be “in the money”

What is At-the-Money?

An option is “at the money” if the current price of the underlying asset is equal to or very close to the strike price. (The strike that is closest to the underlying.)

Example 1: If the current price of NIFTY is 16,000 and the strike price of a call/put option is also 16,000, the option is “at the money.”Example 2: If the current price of NIFTY is 16,010 and the strike price of a call/put option is also 16,000, the option is “at the money.”

What is Out-of-the-Money?

An option is “OTM” if the current price of the underlying asset is less than the strike price of a call option or more than the strike price of a put option.

Call Option Example: If the current stock price is Rs. 900 and the strike price of a call option is Rs. 1000, the option is then said to be “out of the money”. Put Option Example: If the current stock price is Rs. 900 and the strike price of a put option is Rs. 800, the option is then said to be “out of the money”.

Moneyness of Options Summary Table

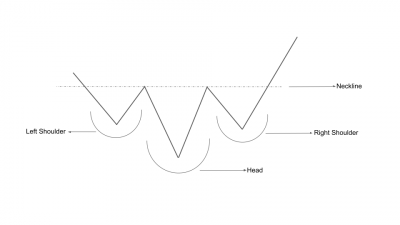

The diagram below explains which contracts are ITM, ATM and OTM with example of NIFTY index. We are assuming the index to be at 16000. All the strikes above 16000 are ITM Puts and OTM calls. And all the strikes below 16000 are ITM calls and OTM Puts.

Intrinsic Value

Intrinsic value is the part of an option’s value determined by the difference between the underlying asset’s current price and the option’s strike price. The intrinsic value of an option is the amount of money earned by the option buyer from an options contract if he has the right to exercise the option on a given day.

Call option Intrinsic value = Spot Price – Strike Price

Put option Intrinsic value = Strike Price – Spot price

Intrinsic value can never be negative. If the difference is negative, it is regarded as zero. All the ITM strikes will have positive intrinsic value. OTM strikes have no intrinsic value. The premium of the OTM option consists only of Extrinsic Value.

Strategy Example 1

Strategy Link: bit.ly/streakmn1

Video Explanation:

Strategy Example 2 – Bull Put Spread

Strategy Link: bit.ly/streakmn5

Video Explanation:

Moneyness Scanner Example 1

Scanning for ITM Call options contracts.

Scanner Link: bit.ly/streakmn3Scanner Example 2

Moneyness Scanner Example 2

Identifying ITM Puts with high Open Interest

Scanner Link: bit.ly/streakmn4

Conclusion

- The term “Moneyness” describes the relationship between the price of an underlying asset and the strike price of an option.

- The three main categories are ITM, ATM, OTM

- Understanding moneyness helps traders choose a strike price for different strategies and market conditions.

- Dynamic Contracts simplifies the strategy creation by dynamically selecting strikes depending on moneyness as determined by the user.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.