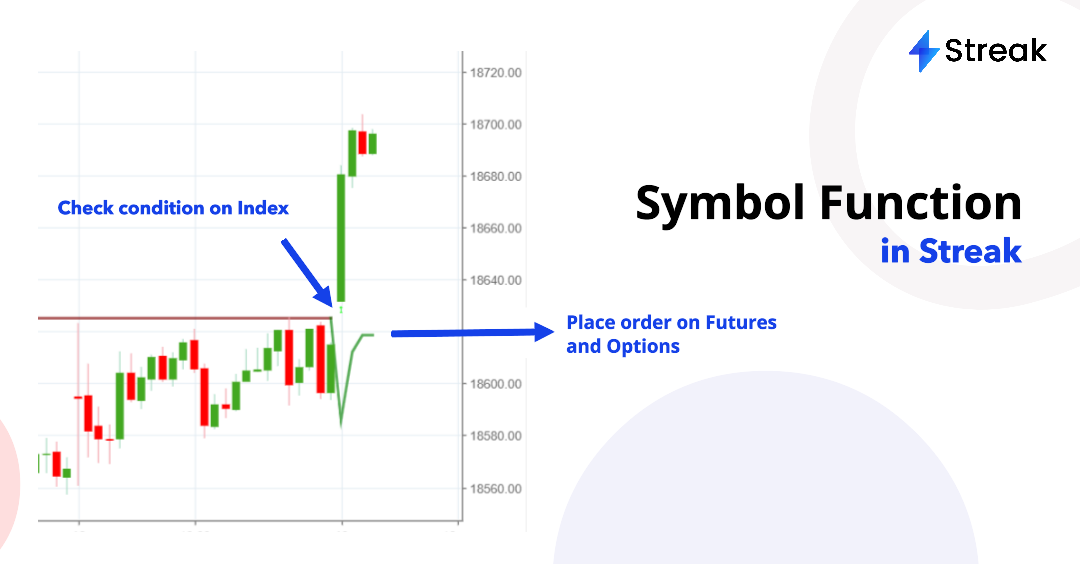

Traders often want to place an order on one instrument on the basis of a condition being checked on another instrument. To cater to this requirement, Streak offers a powerful function called SYMBOL. In this blog, we will delve into the potential applications and benefits of Streak’s SYMBOL function.

The SYMBOL function within Streak enables users to check conditions on a specific instrument, different from the instrument under the instrument section in the Create Strategy page. It takes two crucial inputs: the target symbol(X) and the desired conditions(A). Once these two inputs are provided the conditions(A) are evaluated on the selected symbol(X). When the conditions are met, an Entry/Exit is triggered on stocks, options, or future contracts specified in the instruments section.

Example Scenario: Let’s consider an example. Suppose, we want to create an entry trigger for SBIN (State Bank of India) based on the following conditions:

- On the NIFTY BANK chart, the current closing price (Close(0)) is higher than the 20-day exponential moving average (EMA).

- On the SBIN chart, the current closing price (Close(0)) is higher than the Supertrend(7,3,0).

To implement this scenario, we would use the SYMBOL function as follows:

Here condition (A) will be checked on the symbol (X) since it is inside the SYMBOL bracket. While condition (B) will be checked on the instrument (Y).

The SYMBOL function opens up a number of possibilities for traders to devise intricate trading strategies. Here are a few key applications of this function:

- Cross-Instrument Analysis: Traders can analyze conditions on one instrument and apply them to trigger actions on another instrument. For instance, it is now possible to place an order on a particular stock (Example: Nifty ATM Call option) based on a specific price movement observed in an index (Example: Nifty Index). Here is a link to a sample strategy

2. Enhanced Risk Management: By monitoring specific conditions on different instruments, traders can implement risk management techniques like trigger entry or exit action on multiple positions based on a combination of conditions observed across various instruments. For example, you can place an Entry order on an HDFCBANK option contract based on conditions being validated on Nifty Bank Index and set the Exit condition to be validated on Finnifty Index.

3. Correlation-Based Strategies: Traders often seek opportunities by analyzing correlations between different instruments. The SYMBOL function allows them to capitalize on these correlations (For Example, Relative strength) and trigger actions when specific conditions are met. You can watch the following webinar and refer to this blog to learn more about Relative Strength(RS) and how to implement RS-based strategies in Streak.

SYMBOL Validation and the Overlay Process

When the SYMBOL function is used, the data for the instrument inside the SYMBOL function (X) is fetched and then it is overlayed with the same timeframe data for the scrip selected in the instrument section (Y) and then this combined data is used for entry/exit condition validation.

During the overlay process, the SYMBOL function scrip(X) data also gets trimmed to precisely match the timestamp and number of the candles of the traded scrip data (Y), causing the SYMBOL function scrip to also only have fewer data as (Y). This can lead to a different value of indicator getting calculated. And hence, some alerts can be triggered in the backtest or live deployments which may not match with the SYMBOL chart, even though, these alerts are correct as per the data calculated.

Hence, in situations where the traded instrument is illiquid or has limited data, discrepancies may arise. Illiquidity or missing/dash candles in contracts can cause data mismatches and generate triggers that do not align with the chart. Be cautious when creating strategies using the SYMBOL function, especially when the traded instrument has less data than the symbol selected inside the function.

Note: Trade Candle and Signal Candle are not compatible with the SYMBOL function currently. Trade Candle and Signal Candle are only applicable on instruments being traded on. So, if you are using the SYMBOL function for Entry, Trade/Signal candle cannot mark the underlying instruments’ Entry Candles. Hence you will not find the Trade/Signal candle in the drop-down menu inside the SYMBOL function when writing an Exit condition.

The SYMBOL function in Streak serves as a powerful tool using which traders can expand their strategy possibilities and enhance their decision-making processes. However, it’s crucial to understand the overlaying process and consider potential data discrepancies, particularly when dealing with illiquid instruments. To ensure the effectiveness of strategies utilizing the SYMBOL function, it is crucial to conduct thorough backtesting and analysis. Test different scenarios, validate results, and fine-tune strategies to achieve desired outcomes.

Happy trading!