We have all written mock tests and played practice matches to identify our weaknesses, to test our strengths and to prepare ourselves for the actual event. Paper trading is like a practice match for traders. It allows you to identify the strengths and weaknesses of your strategies and test its performance in the live market without risking any real capital. It is the best way to gain experience without trading with real money.

“By failing to prepare, you are preparing to fail”

One big difference between paper training and live training is lack of emotions. Live trading can be an emotional roller coaster ride, more so for a discretionary trader. However if you are a systematic trader, who trades with a well tested strategy, emotional bias is minimal.

Paper Trading V/s Live Trading

| Paper Trading | Live Trading |

| No Risk | Market Risks |

| Profits and Losses are not real | Profits and losses are real |

| No emotions involved | Emotions involved (Minimum for systematic traders) |

| No Brokerage Charges | Brokerage Charges Applicable |

How to paper trade successfully?

Paper trading can be done manually or automatically using the Streak platform. Streak platform allows users to completely automate their paper trades.Going ahead, we will also discuss the process to do this.

Manual papertrading can be quite cumbersome. It required a lot of time to be dedicated to this task as the traders will need to track the stocks and the strategy signals manually and note down entries and exits. It not only consumes a lot of time but there are other problems associated with it as well. Let us look at the table below and compare both these options:

| Automated Paper Trading | Manual Paper Trading |

| Minimal Time Required | A lot of time required |

| High Accuracy | Low Accuracy |

| No chances of mistakes | Human Error Possible |

| Calculations are done automatically | Calculations need to be done manually |

| Many strategies can be traded at once | Only few strategies can be traded at once |

How to Paper Trading on Streak

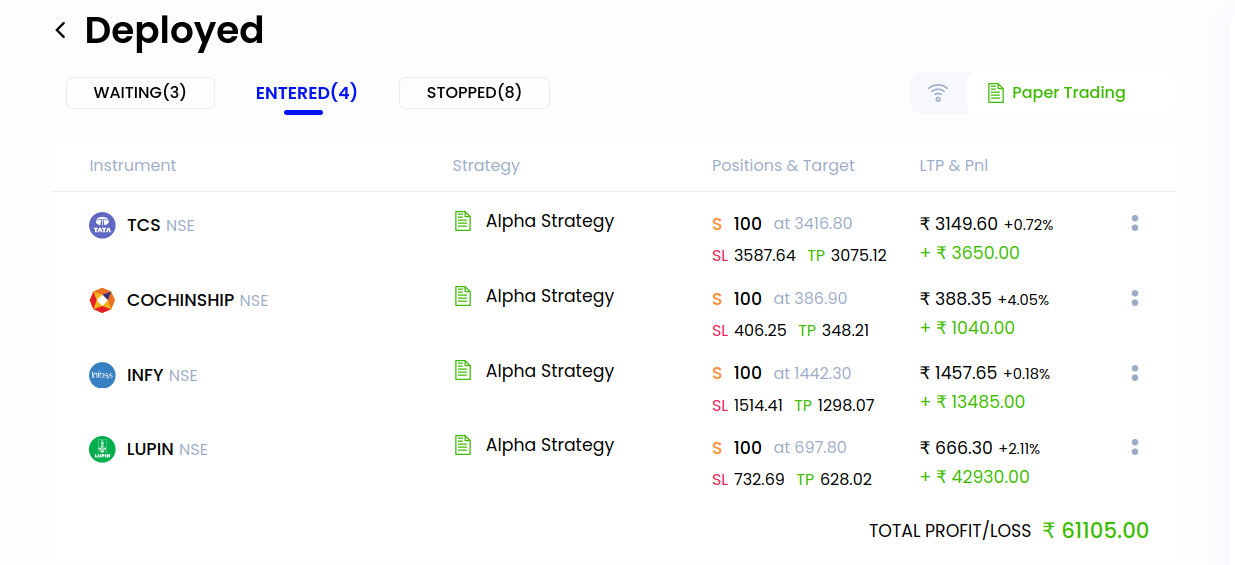

Paper trading on Streak is as simple as 1, 2, 3. First you will need to create a strategy, backtest it then you can deploy it in the paper trading mode. The strategy will execute the trades automatically. Here are the steps and a short video to help you understand the process:

Checking the paper trade P&L and Trade log:

The following video shows how you can check the papertrading P&L and Traded log:

Conclusion

The key takeaways from this article is that Papertrading is a great way to learn about the stock market and how to trade without putting any real money at risk. This will allow you to know the strengths and weaknesses of the strategy and tweak it after observing it in the live market.

Paper trading on Streak is more efficient and powerful than manual papertrading.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.