Why Learn Vertical Spreads?

Vertical spreads allows traders to take directional bets with defined risk and reward. Volatility does impact the strategy but the directionality is of the primary importance. Vertical spreads have near zero gamma, that means the directionality of the strategy is not impacted with changing market conditions. I.e if the strategy is initially bullish, it will remain bullish and if it is initially bearish, it will remain bearish. Vertical spreads are easy to understand and implement. So lets learn how they work and practically implement them in this article.

What are Vertical Spreads?

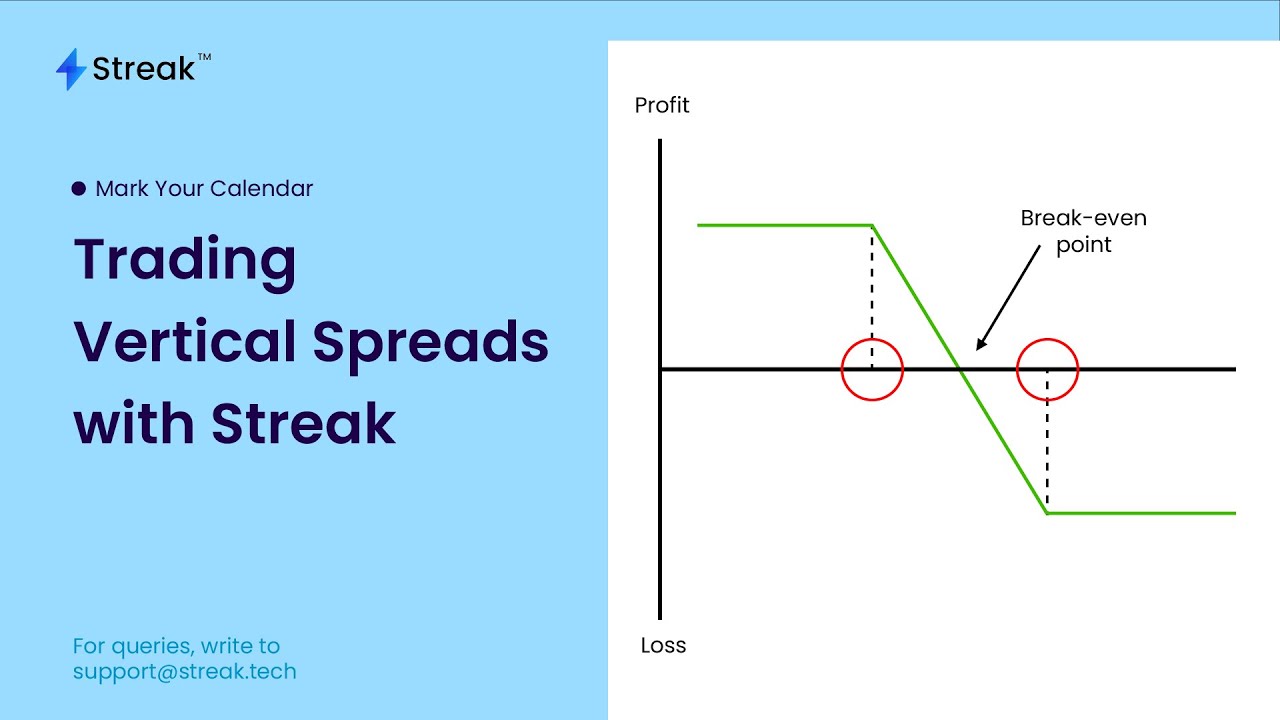

A vertical spread is an options strategy that involves buying and selling options simultaneously, with the same underlying asset and expiration, but at different strike prices. The options are distinguished only by their different exercise prices.

Vertical Spreads are directional Strategies. These strategies can be executed for net credit or net debit. If the strategy is executed for net credit, it is referred to as a credit spread. If the strategy is executed for a net debit, it is referred to as debit spread.

The above image shows various strikes of nifty arranged vertically. If we buy a strike and sell another strike as shown, we create a vertical spread. The strikes can be either calls or puts but both the strikes must be of the same type and expiry. From this image, we can see why these strategies are termed as vertical spreads.

Types of vertical spreads

There are four basic types of vertical spreads. Two bullish and Two bearish. All of them have been listed in the table below:

Whenever a trader buys the lower exercise price and sells the higher exercise price, the spread bullish. Whenever a trader buys the higher exercise price and sells the lower exercise price, the spread is bearish.

Strategy Example 1 – Bear Put Spread

Strategy Link:

How to choose strikes?

Traders are free to choose any pair of options i.e ITM, ATM or OTM to create these spreads. We can base our strike selection based on IV.

ATM options are most sensitive to volatility. Hence, if IV is high, ATM options will be most overpriced. If the IV is low, ATM options will be the most underpriced. So it makes sense to Buy ATM when IV is low and Sell ATM when IV is high.

The other strike can then be selected accordingly.

Example: IV is high and we are bullish and want to deploy a credit spread.

Choice of strategy: Bull Put Spread

Strike to sell: ATM (or strike near ATM) to be sold as IV is high.

Strike to buy: Now, we will have to buy OTM put to complete Bull Put spread since we have already decided to sell ATM strike. (Check this once)

In general, the greater the difference between strike prices, the greater will be the delta. So the spread gap can be decided based on your conviction of the market direction.

Strategy Example 2 – Bull Put Spread

Strategy Link:

https://bit.ly/CreditPutSpread

Scanner Example 1:

This scanner will help you to scan bullish trending indices and stocks. Similarly, we can also create bearish conditions.

Scanner Link:

Scanner Example 2:

This scanner will help you to get alerts whenever the VIX index rises above a predefined level. It can help to identify periods of high IV. Similarly we can also create scanner for low IV.

Scanner Link:

Conclusion

Vertical Spreads are suitable for taking directional bets when the view is moderately bullish/bearish. These strategies offer well defined risk and reward. Vertical Spreads are easy to understand and implement. Vertical Spreads can be executed for net debit or net credit. These strategies can be easily created and backtested on the Streak platform. Traders can also optimize the strategy for various parameters like strike selection, entry conditions, exit conditions etc.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.