Options are a depreciating asset, meaning that their value decreases with time.

In option pricing, time is extremely crucial. Changes in time have a significant impact on the price/premium of options. It gives option sellers/writers an advantage. Time is the only variable that will definitely change and that too in a very predictable way. Lets learn about time value and theta decay in this article.

The Time Value and Theta Decay

The premium that traders are ready to pay for an option over and above its intrinsic value is known as time value. Options pricing is all about probabilities. The more time there is to expiry, the higher the changes of any particular strike price gaining in value due to favorable movement in the underlying. That means, everything else being equal, traders will be willing to pay more for options having higher time to expiry. From a sellers perspective, he will be willing to take unlimited risk for a longer time only if he is receiving enough compensation.

Lets take an Example:

Suppose today Nifty is at 18,000 and you believe that Nifty is going to shoot up from here and expire much higher than 18300. So you go ahead and decide to buy 18,300 Call Option hoping that it expires In-the-money to cover the premium and generate profits. Assuming everything else being equal, which option would you prefer to buy? Most people will choose the 3rd option. As the longer the time to expiry, the higher the change that NIFTY will move above 18,300. So that means, you will also be willing to pay a little extra to buy the higher probability 20 days expiry contract as opposed to the other two options.

What is Theta Decay?

- We have seen that if everything else is equal, traders will be willing to pay more for options having higher time to expiry.

- The previous point also implies that the passage of time will have an impact on the options premium. But by what amount will price change for 1 day change in time?

- ‘Theta’ establishes the relationship of change in options premium with change in time.

- Theta is the rate at which an option’s value diminishes over time.

The below table shows the impact of passage of time (1 day in this case) on options premium. We have assumed that all other market variables remained constant on 12th and 13th November. In such a case, only the passage of time would impact the options premium. The calculation of new premium after a theta decay of 1 day is shown below.

Credit Spreads

Put Credit Spread

Market view: Moderately Bullish

Theta = +ve if the underlying is above the midpoint of Higher and Lower Strikes

Delta = +ve

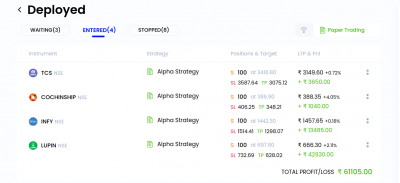

Bull put spreads are credit spreads in which a put option is sold and a lower strike price put option is purchased. The approach aims to profit from a price increase in the underlying asset before it expires. The bull put credit spread will also benefit from time decay and lower implied volatility. The below screenshot is the implementation of the strategy on the Streak platform. You can refer the video given below the image to implement the strategy step by step on the Streak platform.

Call Credit Spread

Market view: Moderately Bearish

Theta = +ve if the underlying is below the midpoint of Higher and Lower Strikes

Delta = -ve

Bear call spreads are credit spreads in which a call option is sold and a call option is purchased at a higher strike price. The approach aims to profit from a price drop in the underlying asset before it expires. The bear call credit spread will also benefit from time decay and lower implied volatility. You can refer the video given below the image to implement the strategy step by step on the Streak platform.

Scanner Examples

Scanner Example 1:

Example to scan for strikes with theta in a particular range

Scanner Example 2:

Example to scan for strikes where the theta has suddenly dropped.

You can refer the below video to check out the steps to create both the scanners:

Conclusion

Extrinsic Value (Time value) is highest at the start of the contract and 0 at the expiry. At-the-money contracts have the highest time value and theta. Far out of the money and Far in the money contracts have least time value and theta. Theta is highest for At-the-Money Contracts and reduces as we move away from At-the-Money on either sides.

The magnitude of theta increases with increase in IV (Prices will decay more if IV is high as high IV will result in high Extrinsic Value). Theta decay accelerates for ATM contracts near the expiry. You can check out the first part of this series by clicking here.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.