Developed by M.H. Pee, the Trend Intensity Index determines the strength of the trend. TII essentially looks at the proportion of prices of prior 30 days being above or below today’s 60-day moving average.

The Math Behind TII

Comparing the price of the last 30 days to the 60-day moving average, the TII helps us gauge the future price trend movement. The formula takes today’s 60-day moving average and each day’s deviation (close – average). Up deviations give a positive amount while the downside deviations give negative amounts.

- Up = (close – average)

- Down = (average – close)

Now, the trend intensity index is the percentage of the total up amount out of the total up and down amounts. The formula is:

Trend intensity index (TII) = {total up / (total up + total down)} × 100

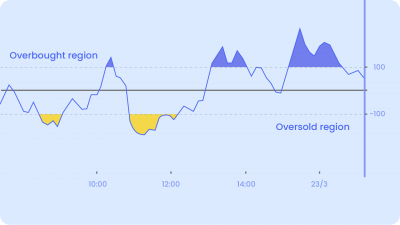

Interpreting Trend Intensity Index

It’s rather easy to read to the TII. If you plot it on your charts, you’ll see that the indicator ranges between 1 to 100. Any value beyond 50 indicates a Bullish trend. And values below 50 indicate a bearish trend. The farther away from the indicator from the 50th point, the stronger the intensity of the trend. Values near 80 mean a strong bullish trend while values near 20 mean a strong bearish trend.

It can be interpreted that the market will continue in the same trend when the TII indicates strong strength. You can enter the market when the current trend is very strong and continue until there is a sign of potential reversal.

The Trend Intensity Index indicator is a quite simple indicator and it is always recommended to use it in conjunction with any other technical analysis tools. It will always be a fruitful strategy to enter the trade when the signals of each indicator confirm each other.