The Vortex Indicator was first proposed by J.W. Wilder in 2010. The beauty of the indicator lies in the fact that it can spot trend reversals and confirm current trends using a pair of oscillating lines. Ever since then, the tool has gained traction as a reliable trend following indicator.

Here’s for the Geeks

If you closely look at the formula for Vortex, you’ll realize that it has many similarities to Wilder’s ADX, the negative directional indicator (-DI), and the positive directional indicator (+DI). To begin with, the Vortx also has 2 lines – an uptrend line (VI+) and a downtrend line (VI-). These lines are typically colored green & red and are used to track positive and negative trends respectively.

The calculation is divided into 4 parts:

1. True Range/TR is the greatest of:

- Current high minus current low

- Current high minus previous close

- Current low minus previous close

2. Uptrend and downtrend movement:

- VM+ = Absolute value of current high minus prior low

- VM- = Absolute value of current low minus prior high

3. Parameter length (n):

- Decide on a parameter length (14 and 30 periods are the most common)

- Sum the last n period’s true range, VM+ and VM-:

- Sum of the last n periods’ true range = SUM TRn

- Sum of the last n periods’ VM+ = SUM VMn+

- Sum of the last n periods’ VM- = SUM VMn−

4. Create the trendlines VI+ and VI-

- SUM VMn+/SUM TRn = VIn+

- SUM VMn-/SUM TRn = VIn−

The process is repeated daily for the VI+ and VI- trendlines.

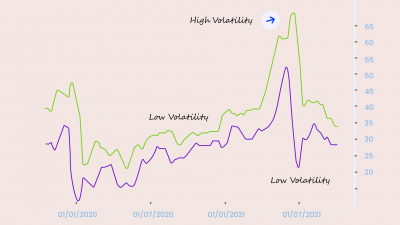

Note, decreasing the look-back period will increase the sensitivity of the indicator and result in more threshold crosses. Adjusting the vortex indicator to longer periods will lower the frequency of whipsaws but generate delayed positive or negative crossovers. On the other hand, shortening the length will elicit many crossovers that fail to generate significant trend movement. As a general rule, fast-moving stocks respond better to shorter-term settings, while slow-moving stocks respond better to longer-term settings.

Interpretation of the Vortex

So, let’s pull out our price charts and plot the Vortex. You’ll see it is a separate graph below the price chart. VI+ and VI- are plotted together on the same graph. During an uptrend, the VI+ (blue) starters climbing up and reach the zenith. And during the downtrend, it starts falling down. On the other hand, the VI- falls as low as it can during strong downtrends and starts climbing up the trend reverses.

The simplest of the signals the Vortex can give is the crossover. When the VI+ crosses an above the VI-, it is a buy signal. And when the VI+ crosses below VI-, it is a sell signal. The Vortex Indicator is still in the testing phase. The full potential of this is still unexploited.

Another important thing to note is that a strong uptrend or downtrend will result in a greater distance between the VI+ and the VI-. And a weaker trend movement will show a smaller length.

VM Thresholds

Before moving any further, let’s keep one thing in mind – the vortex is usually used with other reversal trend patterns for support. Well, this is nothing new. No indicator is 100% accurate. During trending markets, the indicators are pretty useful. But during sideways trends, there’ll be just an insane number of false signals leading to whipsaws.

You can reduce the whipsaws by setting signal thresholds just above & below. Now, if we do a small analysis, a bullish signal can be divided into 2 parts. First, downward trend movement weakens. Second, upward trend movement strengthens. -VI often weakens and moves below .90 before an uptrend starts. After this weakening in downward trend movement, upward movement strengthens as +VI moves above 1.10 to complete the bullish signal. This bullish signal remains in play until countered by a bearish signal. The reverse logic can be applied to generate bearish signals. First, upward trend movement weakens with a move below .90. Second, downward trend movement strengthens with a move above 1.10.

A Vortex Indicator Trading Strategy

The best way to use the Vortex is to use it in conjunction with other major indicators and use the Vortex to filter out and limit false signals. Okay, let’s look at how exactly.

- The extreme high or low on the day of the bullish or bearish crossover becomes the intended entry price, long or short. Those levels might not be hit on the day of the signal, prompting a good-until-canceled buy or sell order that remains in place for multiple sessions, if required.

- If positioned at the time of the crossover, the extreme high or low becomes the stop and reverse action level. Following a negative crossover, a short position should be entered and at the extreme low, the short position should be exited and a long position should be taken. And after a positive crossover, a long position should be entered and at the extreme high, the long position should be exited and a short position should be taken.

You can also combine these entry filters with other risk management techniques, including trailing and profit protection stops.

Happy Trading! 😄