In this article, we are going to learn about Iron Condor (Short Iron Condor). We will learn about its theory, benefits and we will also see how to execute it on the Streak platform.

On the left is a trader, he approaches his friend and they have a conversation. The trader has been trading the short straddle strategy however he is worried because the short straddle has potential for unlimited losses. His friend suggests him that he must explore the iron condor strategy. Why did his friend suggest so? We will find the answer to the question in this article.

Why learn Iron Condor

Margin Required to execute this strategy is very less so it provides higher ROI. The strategy has a limited reward but the risk is also limited.It is a direction neutral strategy. It is a net credit strategy. The strategy benefits from passage of time (Theta Decay).

Since the losses are limited, The traders do not have to worry about the market swinging heavily in either direction like we are seeing these days. Even though it consists of 4 legs, it is easy to understand and implement especially if you already know strangles.

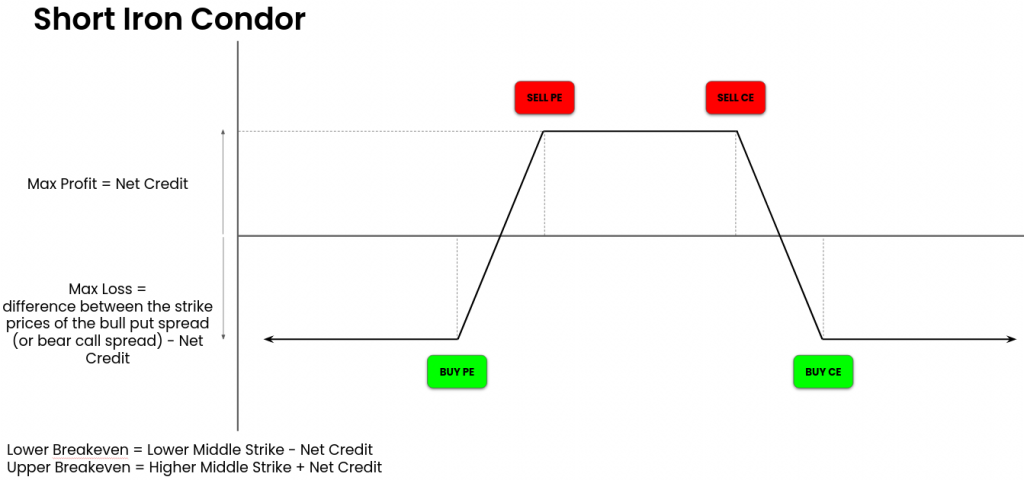

Short Iron Condor Pay Off Diagram

To execute iron condor, we need to execute short strangle (By selling OTM call and put) then for protection, further OTM calls and puts are purchased. We can also say that it is a combination of a bull put spread and a bear call spread.

Short Iron Condor Greeks

How to choose the long strikes?

Here I have taken three different examples with varying strike prices for outermost strikes. The distance between the long put and the short put (Or short call and long call) is decreasing from left to right. As we can see, as the distance decreases, the absolute max profit and max loss both decrease however the profit/loss ratio increases. The margin requirement also decreases as we decrease the distance.

Strategy Example 1

This strategy enters a short iron condor on tuesday morning and exits the position on just before the closing time on wednesday taking advantage of theta decay without long holding period.

Strategy Access Link: bit.ly/IronCStrategy

Iron Butterfly Strategy

Since we are learning about iron condor, I would also like to mention the iron butterfly (short iron butterfly). Instead of a short strangle with protections, it is executed with a short straddle with protections on either side by purchasing OTM call and put. The absolute max profit is higher as compared to the short iron condor however the max profit zone is narrower.

Short Iron Condor V/s Short Iron Butterfly

Strategy Example 2:

In this strategy, we are executing an iron butterfly strategy on Tuesday morning an and holding the position till expiry. The strategy is executed on weekly contracts.

Strategy Access Link: bit.ly/IBStrategy

Scanner Example 1:

Scanner Access Link: bit.ly/sidescan1

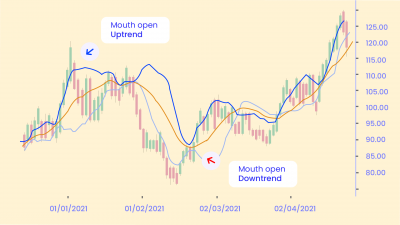

This scanner helps scanning for indices/stocks that have been trading in a narrow range. Please refer the video for explanation:

Scanner Example 2:

Scanner Access Link: bit.ly/VIXScan1

This scanner helps us generate alerts whenever the VIX index crosses a particular value. It helps us track implied volatility. Please refer the video for explanation:

Conclusion

A short iron condor strategy is a net credit strategy with limited reward and risk potential. It is a delta neutral strategy that benefits from falling IV and Theta decay when in the profit zone.

As the new margin framework has drastically lowered margin requirements for hedged positions, the margin requirement to implement iron condor is very low resulting in higher ROI.

The strategy has 4 legs yet it is easy to understand and execute. The strategy should be executed only on highly liquid instruments.

The strategy can be created, backtested and optimized on the Streak platform as per individual’s needs.

Disclaimer: The information provided is solely for educational purposes and does not constitute a recommendation to buy, sell, or otherwise deal in investments.